Summary

Pacific Drilling reveals details of restructuring negotiations.

Both Quantum Pacific and bondholders’ plan call for a wipe out of common equity, but provide an opportunity to invest in new equity along with major players.

Pacific Drilling’s rigs may get jobs at the end of 2018/beginning of 2019.

Pacific Drilling (OTCPK:PACDQ) has just filed a 6-K report revealing the new details of restructuring negotiations. First things first: the bankruptcy court has approved the company’s request to further extend the mediation and exclusive filing period to June 22, 2018, without prejudice to seek further extensions of the exclusive filing period. Now let’s turn to restructuring proposals and other important information that was revealed in the filing.

Quantum Pacific and SSCF Facility lenders proposal

Quantum Pacific is the main shareholder of Pacific Drilling. In this proposal, it has combined forces with certain lenders under the senior secured credit facility. Here’s the result of their work in short:

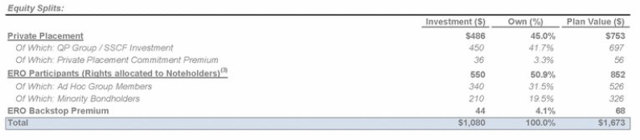

- New equity investment of $1 billion, comprised of $450 million of private placement commitment by QP/SSCF to buy 41.7% of equity and $550 million equity rights offering (ERO) open to the 2017 notes/2018 TLB/2020 notes to buy 50.9% of equity. The proposal also implies that private placement investors will get 3.3% of equity and ERO backstop parties will get 4.1% of equity.

- New debt commitment: $700 million of new first lien facility and $200 million of new second lien facility.

Here’s how it looks like in one table provided in the presentation:

In simple terms, this means that 100% of new equity will be spread among new capital providers – QP/SSCF and the bondholders. The presentation says that other existing equity holders will be able to invest new money on the same terms as the QP Group by purchasing some of the shares that will be purchased by QP. Here’s what it means in practice: if you hold shares in Pacific Drilling, you’ll be offered to purchase shares of “new Pacific Drilling†on the same terms as QP. Your current shares will have no other value than the ability to purchase these new shares. If you don’t want to invest more money in Pacific Drilling, your existing shares will just be cancelled.

Ad Hoc Group Proposal

Not surprisingly, the bondholder proposal is more aggressive (just like it has always been during the ongoing restructuring talks). Bondholders’ plan calls for raising of $1.5 billion of new capital, including $700 million of new first lien debt, $300 million of new second line PIK debt, $200 million of new contingent equity and $300 million of equity rights offering. According to the plan, the revolving credit facility and the senior secured credit facility will be paid in full while current shareholders will be extinguished. The plan also provides an opportunity for QP and/or other existing shareholders to purchase $125 million of existing Ad Hoc Group debt at 60 cents on the dollar. After this, existing shareholders will participate in the existing rights offering alongside the Ad Hoc Group.

Key observation

Neither plan calls for any automatic stake in the new equity for current shareholders. Previously, both QP and bondholders were ready to provide a stake in the new equity to current shareholders. The size of these proposed stakes varied widely, but any previous scenario did not imply that current shareholders will necessarily have to invest more money in Pacific Drilling or see their stake go down to zero.

As I have stated multiple times, the size of Pacific Drilling’s debt and the current fundamental situation in the industry meant that any stake for common equity would have been de-facto a gift from creditors. The company has previously declined such a gift (a 2.5% stake for common shareholders), and now shareholders who won’t invest any additional money into Pacific Drilling will get nothing according to both QP/SSCF and Ad Hoc Group proposals.

Contract news

The presentation revealed that Pacific Bora has a letter of intent from Eni (NYSE:E) for a job in Nigeria. Also, Pacific Khamsin and Pacific Meltem have letters of award for 2-year jobs in the U.S. Gulf of Mexico. Judging by the wording of the presentation, the jobs will begin in the late 2018/early 2019. Letters are not contracts, but typically become one in due time. If so, it’s a major positive news for Pacific Drilling.

Conclusion

As expected, negotiations continue to drift closer to bondholders’ point of view. Any “free†stake for current shareholders is no longer present in any plan. If current shareholders want to retain any stake in Pacific Drilling, they will have to invest more money in the company. The situation is certainly developing according to the negative scenario for the common shareholders.