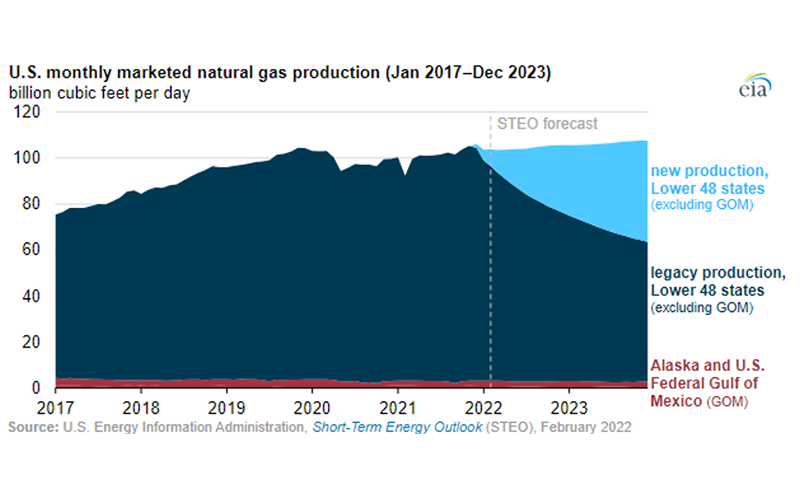

The Energy Information Agency’s (EIA) recent Short-Term Energy Outlook shows a positive future for U.S. natural gas production over the next two years. The government agency forecasts production reaching record highs of 106.6 Bcf/d by 2023 supporting an average price of $3.60/MMBtu with the lion’s share of growth tied to new wells in the Permian, Appalachian, and Haynesville basins. ([1])

This forecast comes just days before Germany halted approval of the Nord Stream 2 pipeline over deployment of Russian forces into disputed Eastern Ukrainian territories. This new sanction restricts import capacity from Russia into Europe by an estimated 1.9 tcf/y. ([2]) In context, over 80% of the European Union and UK’s natural gas demand was met through imports, an increase of 23% over the last ten years, with approximately 30% of those imports coming from Russia. ([3]) The U.S. is uniquely positioned to offset demand through LNG exports, expanding on their 26% share of European imports.([4])

Compounding the issue, Germany’s three remaining nuclear power plants are closing by the end of the year, and France’s commitment to build up to fourteen new nuclear plants lays stretched out to 2050. It remains clear that natural gas will play a critical role in power generation through the EU and highlights their reliance on Russian supply.

Uncertainty tied to Russian aggression in Ukraine, increasing European reliance on imports, and domestic demand all support a robust future for U.S. gas production through 2023.

Seth Berry

Seth.Berry@gmail.com

Seth has worked in the oil and gas industry for 10 years, holds an undergraduate degree in Mechanical Engineering from Louisiana Tech University, and is currently pursuing his MBA at Rice’s Jones School of Business.