Thanks to a partnership with a geoscientist in the Permian Basin, a family-owned oil company is celebrating its largest discovery yet: a 13,000-acre field in Val Verde County holding an estimated 417 billion cubic feet, or 74.2 million barrels, in oil and gas reserves.

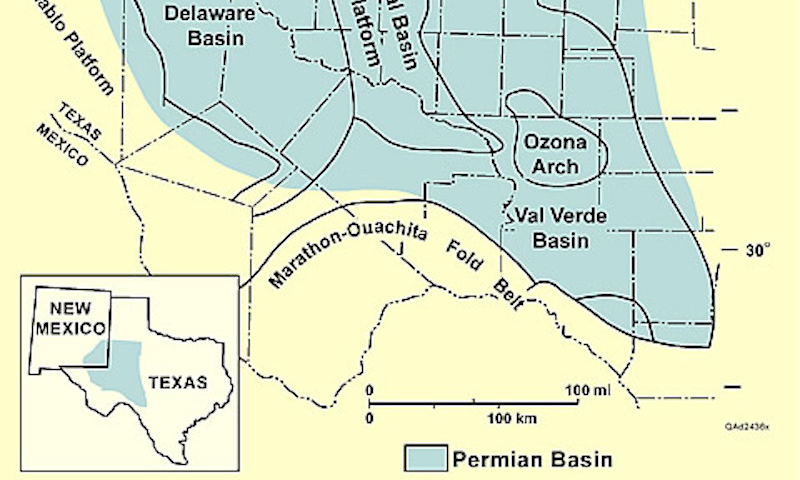

Barron Petroleum, based in Graham, announced the discovery on Monday after working with scientist William J. Purves on the project since 2018. Using Purves’ 3D seismic model to estimate the location and size of the oil and gas reservoirs, the company confirmed the find by successfully drilling two wells at the site, located about 35 miles south of the West Texas town of Ozona.

“We found out that it was exactly what 3D had shown on Dr. Purves’ study,” said Roger Sahota, president and CEO of Barron Petroleum. “We’re very excited and now we’re trying to figure out how to develop it or get someone to join the venture with us. It’s a large project, and our company is small. It’s just me and my three sons and my wife involved.”

Albert G. McDaniel, a petroleum engineer based in Fort Worth, completed the evaluation of the oil and gas reserves and wrote that the project is now so low-risk that it “more resembles that of a development project than an exploration venture.”

In an interview, McDaniel added that Barron Petroleum will have the ability to drill some 60 new wells, allowing energy companies to purchase large quantities of gas or oil from one site.

“This is a major discovery because these new field designations are all going to be made from this one 13,000-acre lease,” McDaniel said. “These are going to be high-volume, high-rate wells from a major new field that will be developed over the next five to 10 years.”

Sahota agrees, and is already negotiating a contract with energy companies Kinder Morgan and Enterprise to lay down a miles-long gas line and sell natural gas drilled out of the field.

“We like to purchase these kinds of properties and take a risk,” he said. “We’ve got our own crews and our own rigs, so we do most of the work ourselves except for the scientific or seismic work.”

This has been a tough year for oil and gas companies, which have suffered from a lack of demand during the coronavirus crisis. Barron Petroleum has not been immune from the economic downturn, cutting its full-time workforce from more than 100 oil field hands before the pandemic to 20, according to Sahota.

But, with oil prices hitting their highest point in five months this week, Sahota is hopeful that his company can continue to explore more potential reserves and rebound from the crisis.

“We’re very happy to have found this, and in Texas,” Sahota said. “This is where all of our projects are right now, and we hope we will have some more discoveries so the state will flourish with our country and we’ll employ a lot of people.”

Source: Star Telegram