(Bloomberg) BP Plc and its partners just spent $28 billion bringing a giant natural gas project in Azerbaijan online, and that may only be the start.

The British oil major intends to drill six new exploration wells in the country by 2020, according to Gary Jones, BP’s regional president for Azerbaijan, Georgia and Turkey. If his expectations are met, the company could find a new gas play that’s about the same size as Shah Deniz, its project that produces the fuel from a field in the Caspian Sea that’s as large as Manhattan.

“Alongside Brazil, Azerbaijan stands out in terms of the areas of focus for the next few years,†Jones said in a phone interview. “It’s a very significant exploration program for us, which demonstrates the confidence and the role that we see in the Caspian.â€

Companies, including BP, are pouring more money into Eurasia, a region with massive, untapped gas reservoirs that are practically next door to fuel-hungry European buyers. In June, BP and partners including Lukoil PJSC and Petronas, started sending gas from the second phase of Shah Deniz through a new link between the Caspian Sea and Turkey. From 2020, the fuel will also flow to Greece, Bulgaria and Italy when the final leg of the pipeline system is completed.

If BP finds more gas in nearby exploration wells, it could use the same pipelines to transport that fuel to Europe.

“That’s why we’ve got quite an ambitious exploration program developing in the Caspian looking at some other very significant gas options,†Jones said. We could “take this source of supply of gas well into the middle of the century.â€

Dependence On Russia

Caspian gas arriving in Southeast Europe will help reduce the region’s heavy dependency on the fuel being piped from Russia. It will offer an alternative source of supply, along with the increasing role of liquefied natural gas from suppliers such as the U.S. and Qatar. The two phases of Shah Deniz will produce about 26 billion cubic meters of gas a year, more than the annual consumption of Poland.

BP is targeting the Shafag-Asiman area, which could be a similar size to Shah Deniz 2, with drilling scheduled later this year, as well as a prospect below the existing Shah Deniz development, where it will drill in 2020, Jones said. It will also look at oil development in two other areas.

Jones said capital spending decisions haven’t yet been affected by a decline in oil prices late in the year, though it renewed BP’s focus on finding out whether there are more big fields in Azerbaijan.

“Our assumption is that the oil price will stay low for a long time, everything we are doing is focused on bringing the cost structure in the Caspian down,†he said. “We have had a lot of success on that working very closely with our partners and the government.â€

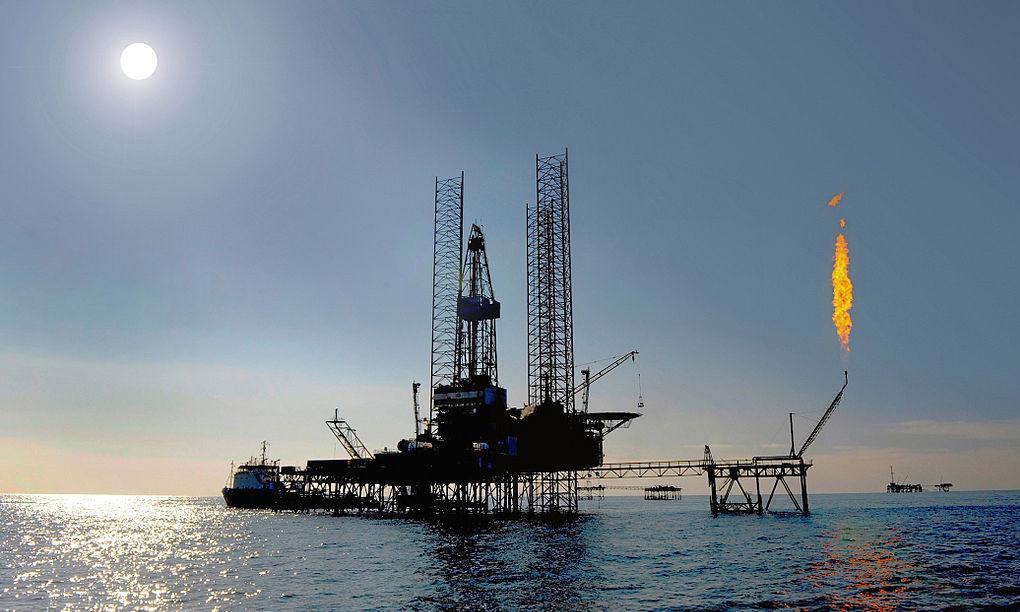

Photo used under the Creative Commons Attribution-Share Alike 3.0 Unported license. Author: Centpacrr

Check out our other current stories!