Investments from global exploration and production companies (E&P) in 2021 are projected to reach around $380 billion, almost flat year-on-year, a Rystad Energy report shows. About 20% or $76 billion of the estimated 2021 investments could be at risk of deferral or reduction, with the remaining amount being categorized in the safer tiers of low and medium-range risk.

The amount is our base case scenario, but with 2020’s market turbulence fresh in mind and the currently uncertain roll-out timing of the recently announced Covid-19 vaccines, it’s worth expanding the forecast to a range of $350 billion to $430 billion, incorporating some scenario deviation.

Investments may rebound to the pre-crisis level of $530 billion by 2023 if oil prices rise to around $65 per barrel – though we should keep in mind that after the previous market crisis in 2014, annual E&P investments never recovered to the pre-crisis level of about $880 billion and instead settled at $500 billion to $550 billion.

Much of that reduction was due to supply chain and efficiency improvements, leaving little scope for further such reductions this time around. Instead, E&P players are pulling other levers to weather this market downturn, such as deferring infill drilling programs, projects FIDs and start-ups, reporting significant write-offs on stranded assets, and reshaping their portfolios to stabilize returns.

“As E&Ps are also speeding up a transition into low-carbon energy, it is possible that this time, too, upstream investments will not return to pre-crisis levels in the long-term, even if they do recover somewhat over the next few years,“ says Olga Savenkova, upstream analyst at Rystad Energy.

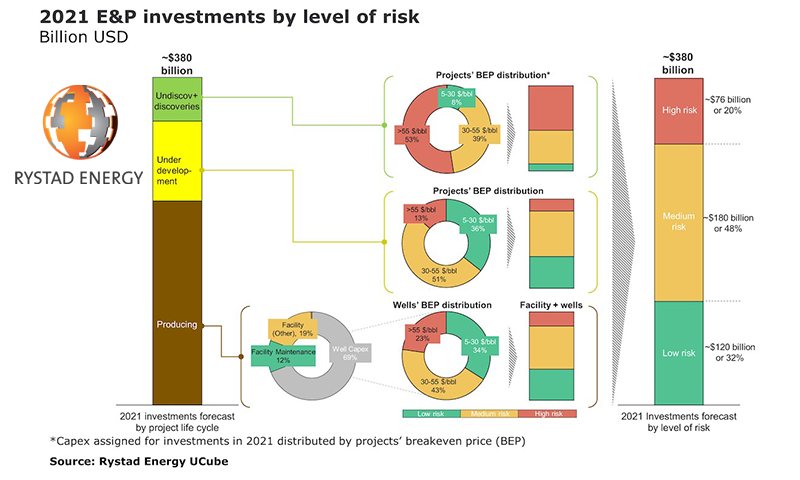

To provide a deeper insight into next year’s expected E&P investments, we have made a risk-weighted analysis of the most critical market indicators to see how much of the total expected 2021 investment is high risk, medium risk and low risk, based on the commerciality of the projects or wells.

Of the total $380 billion of projected investments, about 60% ($234 billion) is likely to come from producing assets, which have two main spending channels: facility and well capex. Within facility capex, about 38% is spent on facility maintenance. This is believed to be a low-risk category, as operators were forced to postpone most of their planned maintenance programs in 2020 due to coronavirus restrictions and lower oil prices. Maintenance work will therefore have high priority in 2021 to avoid unplanned outages in the future.

Well capex is split by the wells’ breakeven price, which gives a clear idea of how much of it might be at risk of deferral or repeal due to lower oil prices. About 23% ($37 billion) of the total well capex is assigned to wells with a breakeven price higher than $55 per barrel, which puts this spending at high risk of deferral. Wells with breakeven price in the range of $30 to $55 per barrel are seen as medium risk, while those with a breakeven below $30 per barrel are low-risk drilling opportunities.

A similar logic is applied for the under-development discovered and undiscovered projects, but with the projects’ breakeven price as a reference point. We see that 10% of the capex associated with projects under development and 30% of the capex for discoveries and undiscovered projects may face deferral due to weak economics.

All in all, this analysis shows that about 20% or $76 billion of the estimated 2021 capex could be at risk of deferral or reduction, while roughly $300 billion is considered low or medium risk.

Source: Rystad