The U.S. energy industry began preparing for a major hurricane strike by Tuesday, cutting crude production at a rate approaching the level of 2005’s Hurricane Katrina and halting oil refining at plants along the Texas/Louisiana coast.

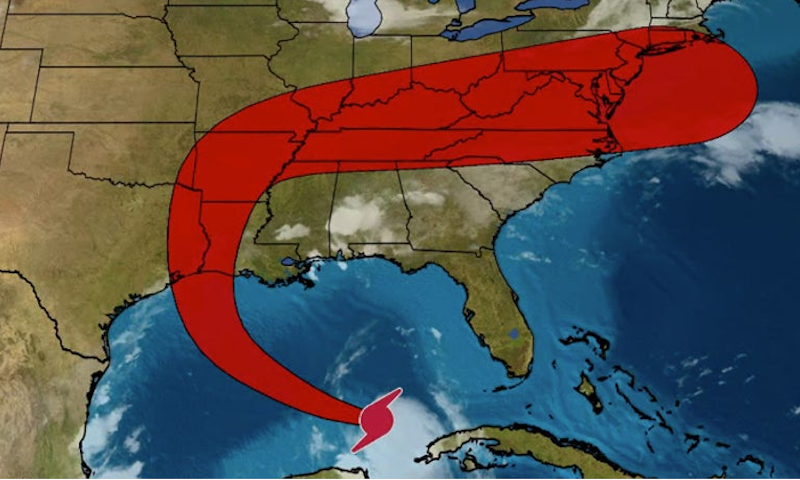

The storm will rapidly gain strength and become a major hurricane with sustained, 115 mile per hour (185 kph) winds when it strikes the coast by early Thursday, according to the National Hurricane Center.

The intensification will bring at least a 10-foot (3-meter) storm surge to the upper Texas coast and could produce a devastating category 4 hurricane, said Chris Kerr, a meteorologist at agriculture, energy and weather data provider DTN.

On Monday, the storm had shut 1.5 million barrels per day (bpd) of crude oil output, 82% of Gulf of Mexico’s offshore production, near the 90% outage that Katrina brought 15 years ago.

Refiners halted facilities that process at least 1.8 million bpd of oil processing, 10% of the U.S. total capacity, according to Reuters tallies. Gasoline prices rose Tuesday on the shutdowns and have jumped 10.3% since Friday.

“There will be a significant storm surge from Galveston (Texas) to the Sabine River,” an area encompassing some of the region’s largest refineries, said DTN’s Kerr. “There are ideal conditions in central and west Gulf for rapid intensification.”

Officials in Port Arthur, an energy city of 54,000 people, and similar-sized Galveston, Texas, each ordered mandatory evacuations as Laura began its march up the central Gulf of Mexico.

The storm will make landfall in an area that accounts for more than 45% of total U.S. petroleum refining capacity and 17% of oil production, according to the Energy Information Administration.

Cheniere Energy Inc, the largest U.S. exporter of liquefied natural gas, evacuated staff and suspended operations at its Sabine Pass LNG export terminal on the Texas/Louisiana border.

Motiva Enterprises, Total SA and Valero Energy began cutting operations at their Port Arthur, Texas, refineries, according to people familiar with the matter. The three combined process more than 900,000 bpd of oil.

Total and Motiva confirmed the shutdowns of their refineries. Valero declined to comment.

Exxon Mobil Corp began shutting production at its large Beaumont, Texas, refinery and reduced output at its Baytown, Texas, plant ahead of a possible shutdown, people familiar with the matter said.

An Exxon spokesman did not have immediate comment. If its Baytown plant fully halts processing, total shutdowns would hit more than 2.3 million bpd.

Source: Reuters