When the Council of Ministers approved the launch of Lebanon’s Second Offshore Licensing Round in April 2019, the initial deadline to submit applications was set to 31 January 2020. However, at the request of International Oil and Gas Companies, and later on due to the implications of the global Covid-19 pandemic this deadline was postponed to 30 April 2020 and then to 1 June 2020 respectively based on the Minister of Energy and Water’s decisions.

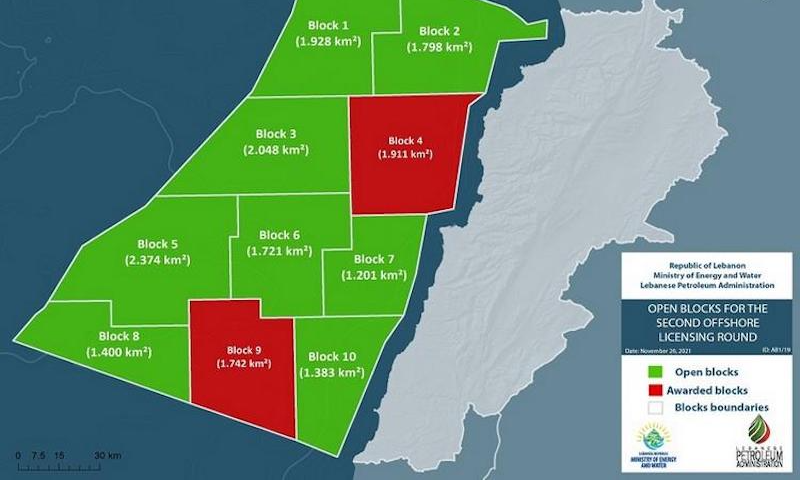

The Minister of Energy and Water has signed the decision relating to the completion of Lebanon's Second Offshore Licensing Round. The launching of this round has already been approved by the Council of Ministers and the deadline for submission of Licensing Round Applications has been momentarily postponed due to the COVID 19 pandemic impacts on the oil and gas industry. The Minister's decision based on the recommendation of the Lebanese Petroleum Administration defined the 15th of June 2022 as the Closing Date for submission of Licensing Round Applications. The Minister’s decision opened for bidding all 8 non-awarded blocks for interested companies knowing that two blocks (4 & 9) were awarded in the first licensing round.

The indicative detailed timetable of the required submissions as described in the updated TP is as follows:

As stipulated in the updated Tender Protocol (TP), once the Applications are received, the LPA will evaluate the Prequalification Applications within three weeks following the deadline for submission of Licensing Round Applications. The results of this evaluation will then be declared by the Minister of Energy and Water before proceeding with the evaluation of EPA Applications as follows:

-

Prequalified Companies

-

Applicants prequalified to have their EPA Applications evaluated (these Applicants do not include any individual company that fails to meet all applicable pre-qualification criteria)

For prequalified Applicants, the LPA will evaluate their EPA Applications and prepare evaluation reports to the Minister of Energy and Water.

The Minister of Energy and Water, assisted by the LPA, will conduct negotiations as stipulated in the updated TP and submit the results of the negotiations to the Council of Ministers.

The Council of Ministers will take the appropriate decision regarding the awards of Exploration and Production Agreements.

Licensing Round Applications remain valid for a period of 180 days as of the closing date deadline of submitting Licensing Round Applications.

Based on the approved recommendation of the Lebanese Petroleum Administration, the Minister of Energy and Water declared on the 23th of November 2021 that blocks 1, 2, 3, 5, 6, 7, 8 and 10 are open to receive bids in the Second Offshore Licensing Round.

The set of open blocks was selected based on the priorities and goals of the upstream oil and gas sector and the objectives of the Second Offshore Licensing Round.

In particular, three main considerations guided the selection process:

-

Selecting attractive blocks that increase the probability of hitting commercial discoveries and that are geologically different from the awarded blocks

-

Selecting border blocks

-

Limiting the number of open blocks to make competition more focused and to maintain the gradual licensing approach

The coordinates of the open blocks are described in the block delineation decree (42/2017).

Source: lpa.gov

Join our mailing list here