Noble Corporation plc and ExxonMobil today announced the execution of a unique commercial enabling agreement for drilling services in the Guyana-Suriname Basin. The agreement defines contract terms for the continuation of drilling services using certain drilling units in Noble’s fleet. The ultra-deepwater drillships Noble Bob Douglas, Noble Tom Madden and Noble Don Taylor, which are currently executing drilling assignments for ExxonMobil offshore Guyana, are included in the framework agreement, and other drilling rigs may be added to the agreement. The Noble Bob Douglas is located on the Liza Phase I field development project, while the Noble Tom Madden and Noble Don Taylor are assigned to exploration drilling in the region.

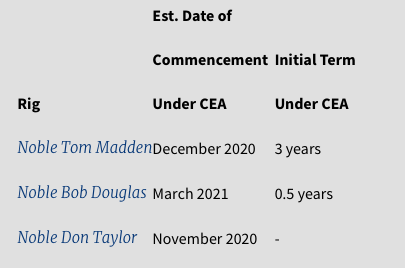

Following the dates listed in the second column of the table below, dayrates earned by each rig will be updated at least twice per year to the prevailing market rate, subject to a scale-based discount and performance bonus which appropriately aligns the interests of Noble and ExxonMobil.

Concurrent with signing of the agreement, ExxonMobil has awarded 3.5 years of term to be added at the conclusion of each rigs’ current contract commitments, as follows:

The agreement provides for allocation of six additional years dependent on future development decisions and government approvals, as well as the potential for incremental contract term, or rigs as required.

Julie J. Robertson, Chairman, President and Chief Executive Officer of Noble Corporation plc, stated, “The Guyana-Suriname basin stands as one of the world’s premier offshore exploration and development opportunities. Since establishing an operating presence offshore Guyana in March 2018 with the Noble Bob Douglas, we have continued to expand our footprint in the region.â€

“The commercial enabling agreement with ExxonMobil takes our regional position a step further, as we benefit from multi-year contract visibility and utilization allocated across three of our premium drillships. This attractive commercial model secures current market pricing dynamics on six-month intervals and important operational economies of scale, and, importantly, the agreement can cover additional Noble drilling rigs. We are honored to strengthen our relationship with ExxonMobil and to have a significant role in this prolific region, which will continue to contribute to the growing need for advanced offshore drilling technology and solutions.†   Â

The Noble Bob Douglas, Noble Tom Madden and Noble Don Taylor are each Gusto P-10000 design ultra-deepwater drillships capable of operating in water depths of up to 12,000 feet. The rigs, which commenced operations during 2013 and 2014, are equipped with advanced drilling systems, and redundant subsea control technology and station-keeping systems.

Source: Noble Drilling

Check out our other current stories!