KIGALI (Bloomberg) — Rwanda is considering partnering with oil and gas companies for the next stage of exploring Lake Kivu for more hydrocarbons, a government official said.

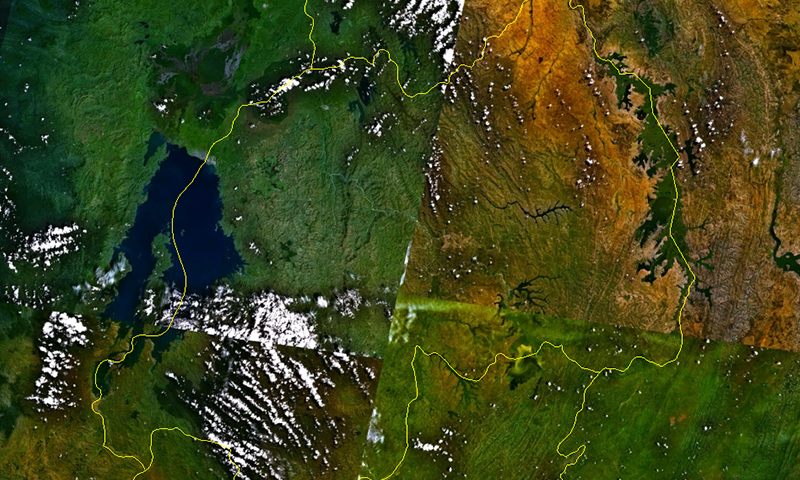

The East African nation has conducted the first round of shallow drilling for geochemistry tests in the methane-gas-producing lake in the west of the country, according to Mines, Petroleum and Gas Board CEO Francis Gatare.

After the ongoing second round of shallow-drilling tests, the state will decide whether to invite private investors to finance 2D or 3D seismic studies, Gatare said in an interview in the capital, Kigali.

“At the right time, when we have derisked the exploration exercise, we will make it known to investors,†he said.

The government will have made a decision before the end of the year, he said.

Rwanda is already extracting methane from the lake that lies in the same hydrocarbon-rich Albertine Graben, where neighboring Uganda has found 6.5 billion bo resources. The gas is already being converted into 26 megawatts of electricity for Rwanda at the KivuWatt power plant.

On the wider mining industry, the state plans a nationwide airborne geophysics survey and has asked Belgium to repatriate data collected when the European nation was Rwanda’s colonial ruler, Gatare said. Mining and quarrying contributes about 2% of the nation’s gross domestic product, according to its statistics agency.

Rwanda is targeting to grow mineral earnings to $800 million from shipping an estimated 10,000 metric tons in 2020 and $1.5 billion from 14,000 tons in 2024. The country is the world’s second-biggest producer of tantalum, a mineral extracted from coltan ore that’s used to make components in smartphones, and Africa’s third-largest tin miner, according to the U.S. Geological Survey.

This year, it could make about $400 million from the exports, compared with $373 million earned last year, Gatare said.

“This year is looking promising,†he said. “We are on course to achieving that.â€

Image courtesy of creative commons under license 3.0