Saudi Arabia’s government expects to earn more from oil next year, an optimism that defies most price forecasts for crude and contrasts with the kingdom’s history of making conservative financial assumptions.

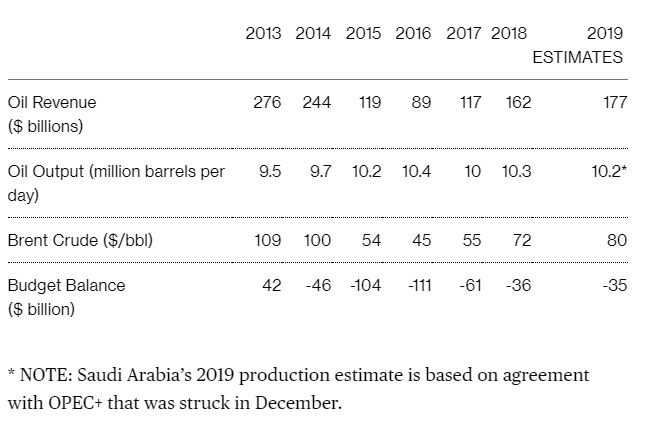

The world’s biggest crude exporter is estimating that oil will average about $80 a barrel in 2019 assuming its production continues at 10.2 million barrels a day and Saudi Aramco won’t increase its allocations to the government, according to Ziad Daoud, Bloomberg’s chief economist in the Middle East. He estimates oil will need to trade above $95 a barrel for the year for the kingdom to balance its budget.

Analysts forecast oil in 2019 will hover around $73 a barrel, according to data compiled by Bloomberg. Saudi Arabia sees its oil revenue rising to a five-year high next year, but will still post its sixth-straight budget deficit.

Key Insights

- Saudi Arabian officials must be anticipating higher crude prices, more oil revenue to government coffers, rising exports, or a combination of all three factors, to justify the increase in oil revenue, Daoud said.

- While crude short-selling continues, with Brent dipping below $58 a barrel on Tuesday and trading at its lowest since October 2017, Saudi Arabia’s bullish call is the latest sign that the kingdom expects its efforts to corral OPEC members and its allies to cut production next year will support prices.

- Assuming a higher oil price than most analysts is a departure from previous budgets. Last year, Saudi Arabia based its 2018 budget on crude averaging $63 a barrel — the global benchmark Brent is on track to average $72 this year. (Qatar assumed $55 per barrel in its budget forecast released last week).

By Mohammed Sergie

Image used under CC0 Public Domain

Check out our other current stories!