The global oil and gas industry requires more than $600 billion of investment annually to keep up with the growing demand for energy even as the world transitions to cleaner forms of energy, according to the managing director and group chief executive of Adnoc.

“After almost a decade of underinvestment in our industry, the world has sleepwalked into a supply crunch. It is time to wake up,” said Dr Sultan Al Jaber, who is also Minister of Industry and Advanced Technology.

Countries cannot afford to “simply unplug” from conventional fuels amid ongoing efforts to transition the world economy away from fossil fuels, he said.

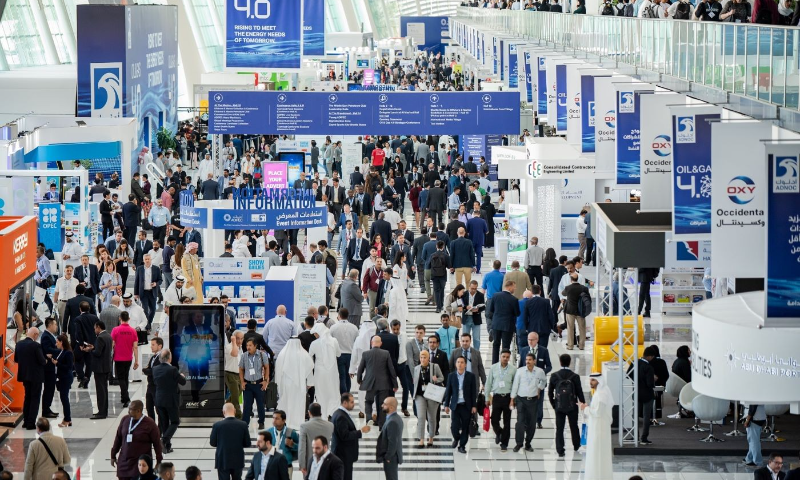

“We cannot just flip a switch,” Dr Sultan told the Abu Dhabi International Petroleum Exhibition and Conference (Adipec).

“As economies bounce back from the Covid-19 pandemic, at the fastest rate in two years, demand has outpaced supply. The oil and gas industry will have to invest over $600bn every year … until 2030 … just to keep up with expected demand,” he said.

The state oil producer plans to significantly increase its investment in hydrocarbons and will raise its output capacity to 5 million barrels per day by 2030.

Oil prices are currently trading at multiyear highs, supported by the rebound in the global economy after extended periods of lockdown due to Covid-19.

The scarcity of gas and coal supplies and rising consumption in India and China have led to a sustained rally in the prices for oil and gas. Oil prices are up about 60 per cent this year.

Brent, the international benchmark under which two thirds of the world’s crude is traded, was down 0.55 per cent to trade at $81.72 a barrel at 11.53am UAE time. West Texas Intermediate, which tracks US crude grades, was down 0.58 per cent at $80.32 a barrel.

Separately, the UAE’s Minister of Energy and Infrastructure Suhail Al Mazrouei dismissed the possibility of crude prices reaching the $100 a barrel due to the possibility of an “oil surplus” in the first quarter of 2022.

The UAE is part of a group of oil producers, commonly known as Opec+, which is bringing additional supply to the markets. The group, led by Saudi Arabia and Russia, will return 2 million bpd by the end of the year.

Dr Al Jaber backed the call for higher oil and gas output.

“At the same time, we are constantly innovating to further reduce our carbon intensity,” he said.

“We were the first company to bring carbon capture and storage to the region, and we are expanding our capacity from 800 thousand tonnes of carbon dioxide per year to 5 million,” he said.

The UAE announced plans to reach net zero emissions by 2050 before Cop26, which was held in Glasgow, Scotland. The country will also become the first Gulf Arab nation to host the Cop summit in 2023.

In line with its initiative to decarbonise, the UAE plans to invest $160bn in clean and renewable energy sources in the next three decades.

“Rewiring the energy system is a multitrillion-dollar business opportunity that is good for the climate, good for humanity and good for economic growth,” Dr Al Jaber told Adipec.

“We need solutions that are both pro-climate and pro-growth. We must invest in the energy that the world needs today while we create the energy system of tomorrow.”

The oil and gas industry should play a pivotal role in supporting this transition, with its “knowledge and skills”, he said.

In October, Adnoc said it would meet up to 100 per cent of its power requirements from solar and nuclear sources after signing an agreement with the Emirates Water and Electricity Company, in line with the UAE’s recent pledge to reach net zero by the middle of the century.

It is set to become the first oil and gas company in the world to completely decarbonise its electric grid at scale.

The supply of clean power to Adnoc will begin in January 2022. The initiative was unveiled by Sheikh Khaled bin Mohamed, a member of the Abu Dhabi Executive Council, chairman of the Abu Dhabi Executive Office and chairman of the executive committee of Adnoc’s board of directors.

The deal will also lock in a long-term renewable electricity off-take agreement for Ewec.

Source: The National

Join our mailing list here