ADES International Holding PLC (“ADES†or the “Companyâ€), a leading oil & gas drilling and production services provider in the Middle East and North Africa (MENA), is pleased to announce that it has entered, through its subsidiary ADES S.A.E., into a short-term exploration contract with Dana Gas for deepwater drilling services in the Egyptian Mediterranean basin. The service will be provided using Vantage’s Tungsten Explorer, comprising one firm well and the contract is estimated to last 77 days, with an extension option to a further three wells.

The services will be subcontracted to ADVantage, a joint venture (“JVâ€) between ADES and Vantage Drilling International (“Vantageâ€), which was announced on 15th November 2017. ADVantage utilises ADES’ experienced local workforce and pre-qualification in the Mediterranean basin with Vantage’s Tungsten Explorer drillship as well as their extensive deepwater drilling experience.

Amid significant gas discoveries and prospective drilling programmes in the region, this contract presents several attractive commercial opportunities which could be realized through an extension over the long-term.

The contract will operate on a profit-sharing basis, enabling ADES to generate additional revenue without incurring the significant capital expenditure normally associated with deepwater drilling.

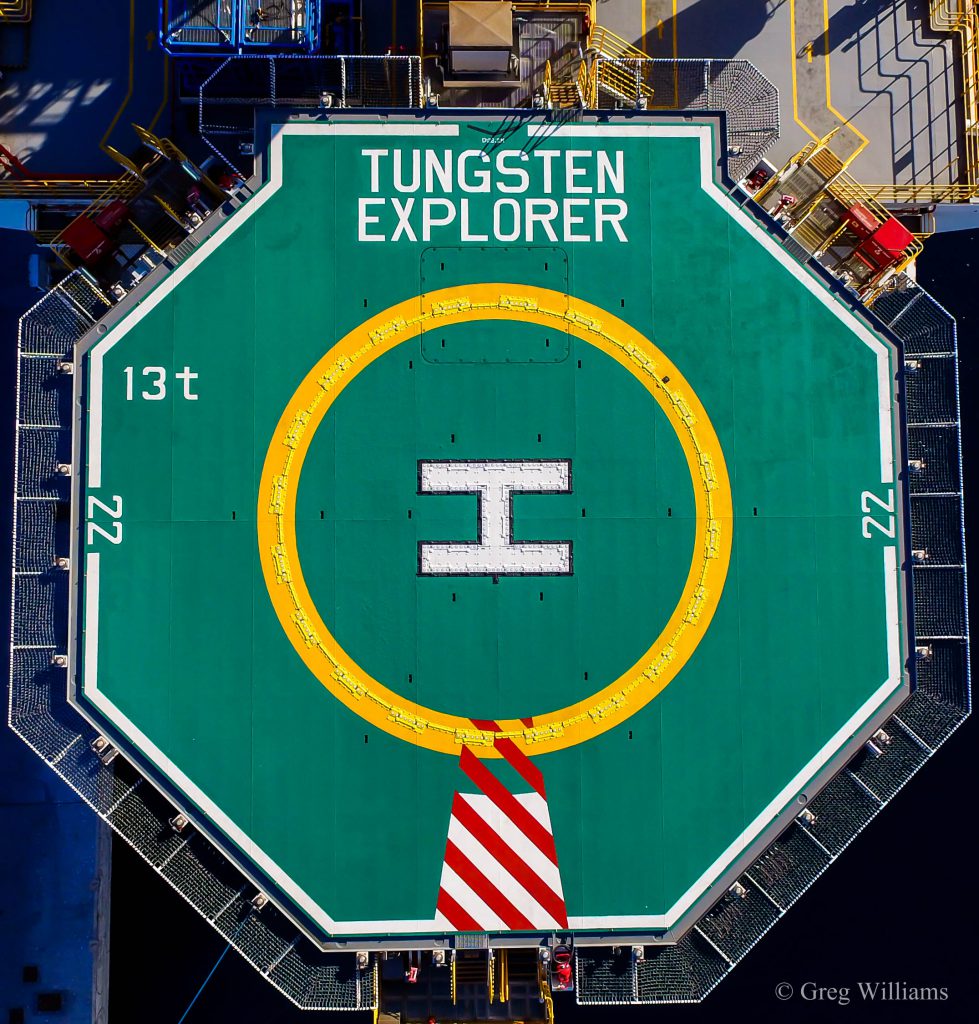

Photos of the Tungsten Explorer during SPS in Grenadilla Spain

-

DCIM100MEDIADJI_0028.JPG -

DCIM100MEDIADJI_0039.JPG -

DCIM100MEDIADJI_0061.JPG -

DCIM100MEDIADJI_0018.JPG -

DCIM100MEDIADJI_0019.JPG -

DCIM100MEDIADJI_0025.JPG -

DCIM100MEDIADJI_0024.JPG

Dr. Mohamed Farouk, Chief Executive Officer of ADES International Holding, said:

“Since the time of our listing, we have consistently highlighted the attraction of the asset light model. We are extremely pleased to have secured our first contract in the Mediterranean with Dana Gas, where we will build on our track record of consistently delivering a high-quality service to our clients. This contract is fully consistent with our approach, as we continue to see attractive long-term prospects for the JV and our partner Vantage’ high quality assets in the ultra-deepwater Egyptian market.â€

Mr. Ihab Toma. Chief Executive Officer of Vantage Drilling International stated:

“We are delighted to put the Tungsten Explorer back to work so soon after it completed certain upgrades as well as finishing its five year campaign for Total in Congo. This award recognizes the long track record of excellent performance and hard work of the crew of Tungsten Explorer. In particular, we would like to express our appreciation and gratitude to Dana Gas for giving Vantage and ADES its trust. We look forward to working with ADES, through our joint venture, and continuing to provide industry leading service for our clients.â€

Check out our other current stories!