MARKETS ROUT

Financial markets were thrown into turmoil on Monday after Saudi Arabia slashed oil prices and set plans for a dramatic rise in crude production. The jolt added to concerns over the spread of the coronavirus and the fears of a global recession.

Oil slumped around 30%, while MSCI’s broadest index of Asia-Pacific shares outside Japan lost 3.9% for its worst day since late 2015. Panicked investors bought bonds and the yen, which are deemed as safer assets to own right now.

“Wild is an understatement,†said Chris Brankin, chief executive at stockbroker TD Ameritrade Singapore.

“Across the globe you would have every broker/dealer raising their margin requirements … trying to basically protect our clients from trying to leverage too much risk or guess where the bottom is.â€

ITALY BACK TO WORK – SORT OF

Millions of Italians try to go back to work today after this weekend’s virtual lockdown across much of its wealthy north, including the financial capital Milan. The unprecedented restrictions, which aim to limit gatherings and curb movement, will impact some 16 million people and stay in force until April 3. It will be interesting to see just how effectively measures such as the requirement on bars to keep customers one meter apart from each other can be enforced. This morning its prime minister is out pledging a “massive shock therapy†of new spending to offset the economic impact of the coronavirus outbreak.

SAUDI ARABIA LOCKS DOWN PROVINCE, CLOSES SCHOOLS

Saudi Arabia imposed a temporary lockdown on its eastern oil-producing province of Qatif, home to most of its 15 coronavirus infections, and suspended schools and universities nationwide.

Four new cases, including an American arrival who visited Italy and the Philippines, took the tally to 15 on Monday, as the kingdom suspended travel with nine nations, from neighboring United Arab Emirates to Bahrain, Kuwait, and Egypt.

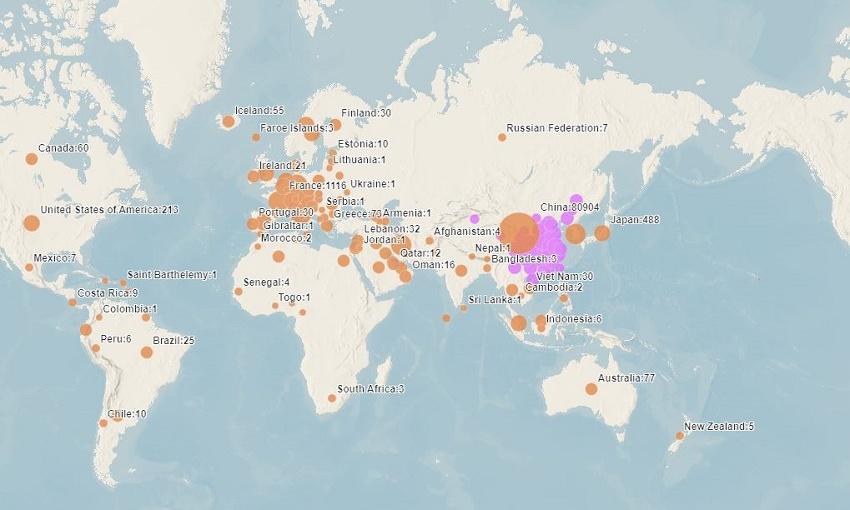

CHINA SPREAD SLOWS, SAYS TO STAY VIGILANT

The number of people infected with the coronavirus topped 107,000 globally, according to a Reuters tally of government announcements. But mainland China, outside the epicenter of Hubei province, reported no new locally transmitted cases for the second straight day.

Still, a senior Communist Party official warned against reducing vigilance.

“We must stay cautious, not be blindly optimistic and must not have war-weariness,†said Chen Yixin, secretary general of the Communist Party’s Politics and Law Commission.

Walt Disney Co’s Shanghai Disneyland said on Monday it will resume a limited number of operations at its resort as part of the first step of a phased reopening, though the main theme park will remain shut.

Source: Reuters

Check out our other current stories!