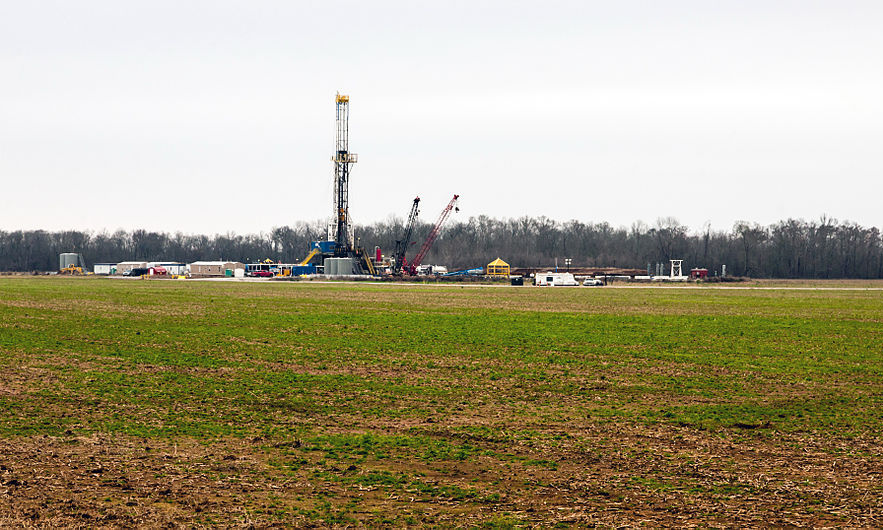

Bloomberg- Exxon Mobil Corp. will use renewable energy to produce oil in West Texas.

Under 12-year agreements with Denmark’s Orsted A/S, Exxon will buy 500 megawatts of wind and solar power in the Permian Basin, the fastest growing U.S. oil field. It is the largest ever renewable power contract signed by an oil company, according to Bloomberg NEF. Terms weren’t disclosed.

“It will be interesting to see how the other oil majors respond,†Kyle Harrison, a BNEF analyst, said. “A purchase like this has historically been unprecedented.â€

Exxon, which was sued by investors who alleged the company downplayed risks of global warming, is turning to clean energy as it becomes cheap enough to compete with fossil fuels. The wind and solar farms are being built in a region where electricity demand is soaring as oil production grows.

Power Battle

“We frequently evaluate opportunities to diversify our power supply and ensure competitive costs,†Julie King, a spokeswoman for the Irving, Texas-based oil producer, said in an email. The company denies misleading investors about climate change.

Booming production in the Permian Basin is helping Exxon offset declining output elsewhere in the world. But output in the region has grown so fast that infrastructure including pipelines and power plants have struggled to keep up.

One area of the Permian, called the Delaware Basin, consumed the equivalent of 350 megawatts this summer, tripling its load from 2015. That’s enough to power about 280,000 U.S. homes. Providers say demand is likely to triple again by 2022.

Half the power Exxon will buy will come from the Sage Draw wind farm, which Orsted plans to finish building in 2020, according to a slide from an investor presentation Wednesday. The rest will be from the Permian Solar farm, scheduled to be finished in 2021.

Orsted, the world’s largest developer of offshore wind farms, has deep roots in fossil fuel. It was previously called Danish Oil and Natural Gas, or Dong, before shifting toward renewables about a decade ago. The company divested its upstream oil and gas business last year and rechristened itself Orsted, borrowing the name of a scientist who discovered electromagnetism in the 1800s.

Texas already has the most wind power of any state, with more than 23 gigawatts. That’s triple the next biggest market, Oklahoma. Texas is the fifth largest solar market, with about 2.6 gigawatts. That’s forecast to double next year, according to Morningstar Inc.

In August, Exxon was said to be seeking renewable energy under long-term contracts from a group of potential developers.

— With assistance by Brian Eckhouse(Updates with Orsted background in ninth paragraph.)

Photo used under the Creative CommonsAttribution-Share Alike 2.0 Generic license. Author: Flickr upload bot

Check out our other current stories!