- Pacific Drilling files an 6-K where it states that it was granted an extension to an exclusive period for filing a restructuring plan.

- Oil prices are rather high, but drillship valuations have not materially improved.

- At this point, common equity is at creditors’ mercy.

Summer is usually quiet for business, but in Pacific Drilling’s (OTCPK:PACDQ) case summer will definitely be hot. The reason for this is that the company continues to go through restructuring and has not filed a restructuring plan yet.

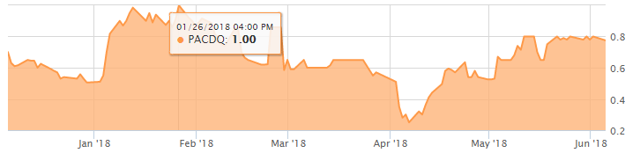

The company has just filed an 6-K where it stated that it was able to extend the mediation and the exclusive filing period to June 15, 2018. The previous deadline was June 4, 2018. It looks like the ultimate solution will soon be presented to the public as the extensions are getting shorter. Before June 4, 2018, the deadline was May 21, 2018. Meanwhile, Pacific Drilling’s shares are stuck near the $0.80 level for quite some time:

Source: Seeking Alpha

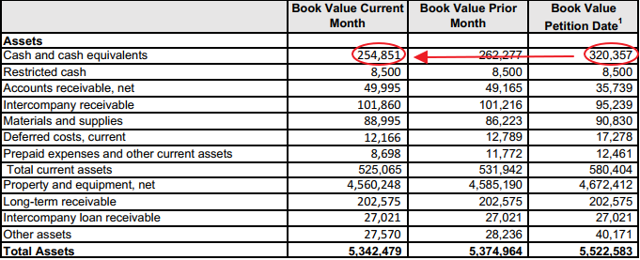

In my opinion, Pacific Drilling’s creditors must be feeling an increasing sense of urgency regarding the speed of restructuring plan development as the company’s financial situation continues to deteriorate. According to the latest monthly operating report (docket 380), Pacific Drilling’s cash stood at $255 million compared to $320 million at the petition date:

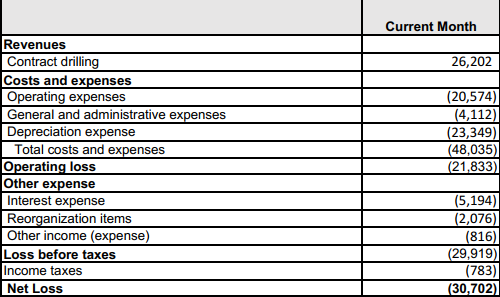

Revenues barely exceed operating expenses, while G&A, interest expenses and restructuring fees push the company’s results into the red zone:

In my opinion, the market is rather optimistic on Pacific Drilling right now. As has been disclosed in the first quarter report, the company now has only one working drillship, Pacific Sharav. Despite rising oil prices, valuations for drillships have not been increasing. The reasons for this phenomenon are lack of drillship jobs and significant oversupply of modern drillship. So, while Pacific Drilling’s fleet is modern and theoretically attractive, its valuation (as per Bassoe Offshore) is just $1.4 billion – $1.55 billion. As liabilities subject to compromise in the ongoing restructuring are $3.1 billion, any recovery for common equity will de-facto be a gift from creditors.

Previously, creditors were willing to provide such a gift, but the company insisted on the much bigger recovery for common shareholders. Obviously, Pacific Drilling tried to gain time waiting for the recovery of the offshore drilling market that should have pushed rig valuations to the upside and provided some leverage in negotiations with creditors. Unfortunately, this did not happen. While oil prices have increased, drillship valuations have barely moved. The fact that only one rig is working does not help valuations either.

I believe that the restructuring plan development process is on the finish line. The court started granting shorter extensions, and ultimately the parties will have to come to common terms under the ongoing mediation. I do not think that common equity has any chances to get more than the 2.5% stake previously offered by creditors. Also, I’m not so sure if it’s a good idea to have more than $1.1 billion of debt after restructuring for Pacific Drilling (last creditors’ proposal implied extending maturity of credit facilities rather than their equitization). If a portion of these facilities is equitized, the stake for common equity will decrease even more. At this point, I don’t think that Pacific Drilling shares are worth a gamble. Stay tuned, perhaps, will hear some news on June 15.