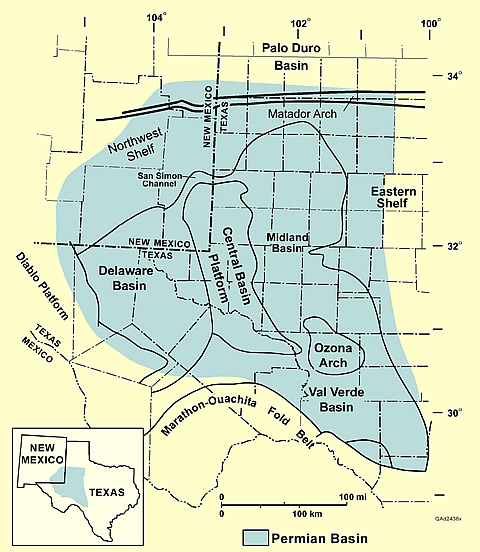

The Permian Basin made headlines in 1920 when a West Texas well found oil about 2,750 feet deep. The W.H. Abrams No. 1 well was named for Texas & Pacific Railway official William Abrams, who owned the land and had leased mineral rights to the Texas Company (later Texaco). After “shooting†the well with nitroglycerine, a column of oil announced discovery of the West Columbia field. It was part of the Permian Basin, covering more than 75,000 square miles in 43 counties of western Texas and southeastern New Mexico.

The Permian Basin produced about 20 percent of America’s oil by the 2010s.

Read more history at American Oil and Gas Historical Society

“As a crowd of 2,000 people looked on, a great eruption of oil, gas, water and smoke shot from the mouth of the well almost to the top of the derrick,†notes a Texas State Historical Marker in Westbrook.

“Locally, land that sold for 10 cents an acre in 1840 and $5 an acre in 1888 now brought $96,000 an acre for mineral rights, irrespective of surface values…the flow of oil money led to better schools, roads and general social conditions.â€

Another West Texas discovery well in 1923 near Big Lake brought an even greater drilling boom that helped establish the University of Texas (see Santa Rita taps Permian Basin). The Permian region is expected to account for more than half of the growth in U.S. oil production through 2019, according to the Energy Information Administration.

Read more at Britannica.Com

More than half of the world’s petroleum derived from Permian times has come from the Permian Basin. Although some older strata are also productive, the majority of the oil and gas obtained from the Permian Basin has been recovered from Permian rocks. Though oil and gas were already being extracted from the Permian Basin by the mid-1920s, most of the petroleum production activity has taken place since the 1950s. As a result, for a large part of the 20th century the Permian Basin played a significant role in the economic development of the state of Texas, including such towns as Midland, Odessa, and Marathon. Petroleum geologists often use the Permian reef system as a model for the exploration of other petroleum source and reservoir rocks.

Photo Used: Aresco History of the Permian Basin

Check out our other current stories!

- No bids at B.C.’s July oil and gas sale

- Vedanta to invest $650 million in new oil and gas blocks

- GOM region wide lease of 77.8 million acres set for August

Rig Lynx was launched December 2017, our oil and gas news was viewed over 373,000 times in 2018 and our social networking application generated over 268,000 clicks in 2018. Our current foothold has rivaled the largest in the industry and we are just getting started.