Driven by its significant investment in Guyana, ExxonMobil is leader of the pack among the top oil and gas explorers of 2018, according to Rystad Energy’s annual exploration review covered in their recent press release.

“ExxonMobil was exceptional, both in terms of discovered volumes and value creation from exploration,†said Rystad Energy head of upstream research Espen Erlingsen.

Erlingsen added:

“Last year, Rystad Energy witnessed the revival of offshore exploration activity. Improved market conditions and operational efficiencies, along with sustained cost deflation, allowed many E&P players to move forward with promising high impact exploration campaigns in 2018.â€

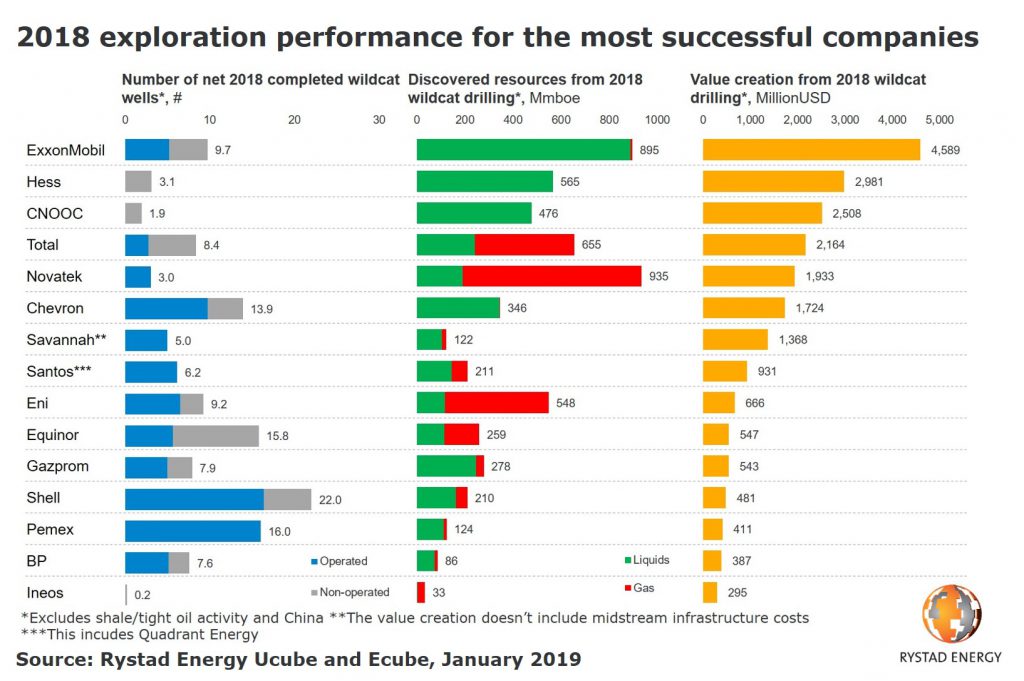

To measure performance, Rystad Energy looked at the number of exploration wells, net discovered resources and the value creation from wildcat exploration (wells drilled in new prospects) during 2018.

In 2018, the US supermajor ExxonMobil drilled 2.7 net wildcat wells in Guyana, and discovered close to 2 billion barrels in additional gross resources in the Stabroek block (which includes the giant Liza discovery). These volumes are extremely valuable, as they will add to the large existing development solution in this region.

Hess and CNOOC come in at second and third place in terms of value creation in 2018. However, both are partners in ExxonMobil’s Stabroek block, and have therefore benefitted from the Guyana success as well.

Total ranks as the second best oil major, having created about $2.2 billion in valuation from 2018 exploration. The company had particular success in the US Gulf of Mexico (Ballymore), the UK

Savannah Petroleum was the company with the highest value creation per barrel of oil equivalent (boe) last year thanks to its work in Africa. Rystad Energy estimates the resources discovered in Niger Block R3/R4 have a net present value of more than $10 per boe.

Russian independent Novatek that had the greatest amount of discovered resources in 2018, at 935 million boe. Novatek’s volumes stem from the North Obskoye discovery in the Kara Sea.

“Top E&P companies registered many exploration successes in 2018, as majors and minnows alike made significant discoveries, but ExxonMobil was exceptional,†Erlingsen added.

Illustration from “Sales Excellence†video from ExxonMobil

If you like what we do then let us know by becoming a patron through Patreon, for as little or as much as you would like!

Hit the button below!

Check out our other current stories!