A decade ago, the media was filled with stories about peak oil, numerous books were published on the subject (such as Half Gone and $20 a Gallon!), and even the Simpsons mentioned it in an episode about doomsday preppers. Now, the topic is largely forgotten and the flavor of the month is peak oil demand. Anyone concerned about the quality of research that works its way into the public debate should be curious about how so many were so wrong for so long. (Buy my book for the full story.)

First and foremost, realize that in the 1970s, numerous analysts and institutions made similar arguments, arguing that geological scarcity was responsible for higher prices not the two disruptions of production in 1973 and 1979. Indeed, in the months before oil prices collapsed in 1986, the consensus was that prices were too low and had to rise to make upstream investment profitable, despite the fact that OPEC production was collapsing (down from 30 mb/d in 1980 to 15 in 1985). You would think that this would make people more skeptical about claims that geological scarcity was responsible when the shutdown of Venezuelan production and the second Gulf War cut off Iraqi supplies sent prices higher starting in 2003.

Such was not the case. In fact, on September 21, 2004 the Wall Street Journal published a front-page story “As Prices Soar, Doomsayers Provoke Debate on Oil’s Future,†quoting the founder of the Association for the Study of Peak oil as saying “Holy Mother! The good ol’ moment’s arrived!â€Â Oddly, the article didn’t mention the alternative explanation for high prices, namely the loss of production from Venezuela and Iraq, about 1 billion barrels up to the article’s publication.

The current era of peak oil warnings started twenty years ago, when Scientific American published an article by two retired geologists called “The End of Cheap Oil,†which presented the idea that world oil production would soon peak while demand kept rising, creating economic shock waves and even ‘the end of civilization’ as one co-author said subsequently. Since the oil price collapsed to $12 a barrel that year, most paid little heed at first, but as oil prices began to rise five years later, attention soared.

Few realize the debate began a year earlier, in the pages of the Oil & Gas Journal, where members of the opposing camps put forth their views. Colin Campbell, who later became founder of the Association for the Study of Peak Oil (and coauthored the 1998 Scientific American article), wrote an article titled “Better Understanding Urged for Rapidly Depleting Reserves†in which he warned “there is comparatively little left to find†and “the world’s political, economic, and political stability, which relies on an abundant supply of cheap oil, is in serious jeopardy.â€Â His core argument was that the amount of recoverable crude oil, which he put at 1.8 trillion barrels, was smaller than most realized, because of misreporting and misinterpretation of the data.

The contrary view was put forth in the same journal in an article by M. A. Adelman and this author, noting past pessimism: “For many years now, nearly every forecast has been: an early peak, then in 3-5 years decline in virtually every place but the Persian Gulf.â€Â And “The oil industry has always been in a tug-of-war between depletion and knowledge. It takes endless effort and investment to renew and expand reserves. But resource limits are a phantom….Repeatedly, the forecasts are revised with a higher and later peak….These estimates of declining reserves and production are incurably wrong because they treat as a quantity what is really a dynamic process driven by growing knowledge.â€

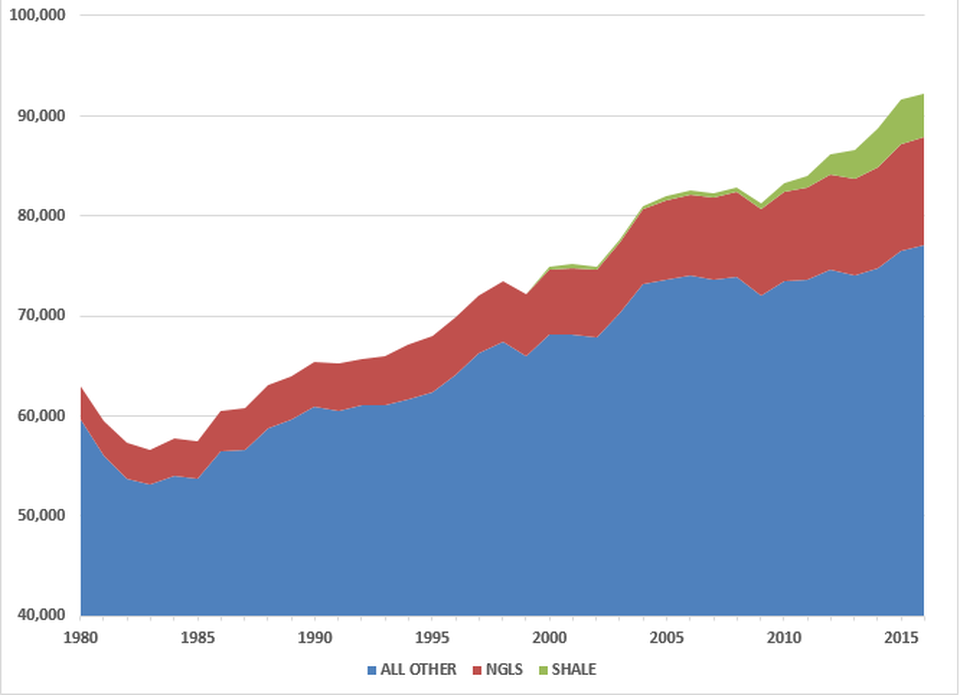

Since then, the peak oil advocates have repeatedly increased their estimates of recoverable resources (Campbell’s went from 1.575 to 1.9 trillion) and pushed the date of the peak further out, exactly as Adelman and Lynch argued, while trying to argue that the increase in oil supply was ‘unconventional’ oil which they were not analyzing. Of course, they tend not to mention that their 1998 article claimed “But the industry will be hard-pressed for the time and money needed to ramp up production of unconventional oil quickly enough.â€Â Similarly, many argue that the growth has been from NGLs or shale, not conventional oil, but the figure below refutes that. (continued on page 2)

Check out our other current stories, we dare you…

- Stena Forth new contract with Tullow in Ghana

- $110 Billion in Projects Kicking Off

- 250 years of energy, from where?

<

The general view of the issue is that shale oil saved us from peak oil, and the issue has largely disappeared from the media, to be replaced by warnings of peak oil demand, but there are still articles about peak cobalt, peak cocoa and similar scares. Rather the way your local news station constantly reports on some new threat to the public (germs in airplane bathroom sink water, dangers from household cleaning products, etc. ad infinitum).

Unfortunately, very few people realize that the entire concerns about peak oil were based on misinformation or junk science. Specifically, the research was not scientific at all but statistical analysis so badly done that it wouldn’t pass a first-year college course. The work by Campbell and Laherrere relied on the basic idea that geology determined production trends, and thus trends could be safely extrapolated based on the bell curve model. If production was declining, that is. Economics didn’t matter because ‘you have to find oil before you can produce it’ and if it’s there, it will be produced. Technology could not improve recovery because “Technology cannot change the geology of the reservoir, but technology (in particular horizontal drilling) can help to produce faster, but no more…â€Â (Jean Laherrere)

The majority of this is nonsense. Production usually doesn’t follow a bell curve, and when it does, it is the result of the effects of exponential growth and decline. (Many repeated the claim that geology meant oil production in a region had to follow a bell curve without actually checking the data.) Instead, changes in oil prices, fiscal terms, and access to resource basins cause production to fluctuate all the time—and often surpass the supposed ‘peak’ level that peak oil advocates identify.

——Download our free app and connect with the Next Generation of Oil and Gas——

Many of the arguments reflected their authors’ ignorance of either the industry or forecasting. Simmons claimed that hearing the Saudi oil company used ‘fuzzy logic’ to model reservoirs convinced him they had problems, since he’d never heard of it. (It’s just a decades-old programming method.)  Joe Romm said “Steep falls in oil production means the world now needed to replace an amount of oil output equivalent to Saudi Arabia’s production every two years, Merrill Lynch said in a research report.â€

Apparently, he didn’t know that Jimmy Carter, in his 1977 speech on the energy crisis, said, “…just to stay even we need the production of a new Texas every year, an Alaskan North Slope every nine months, or a new Saudi Arabia every three years. Obviously, this cannot continue.â€

Thus, the publications and predictions have by and large not come true—often rather spectacularly. Russia was said to be unable to surpass 8 mb/d, and when they did, 9 mb/d, and when they reached 10 mb/d, a quick collapse was predicted. Production there is over 11 mb/d and still increasing. And a 2005 book describing the imminent collapse of Saudi production, presaging world production collapse, was not only riddled with errors but has proven wholly invalid. The Saudis have experienced no production difficulties, indeed had to cut back to support prices; and world production has grown by about 15 mb/d since the 2005 peak prediction by that author and others.

Arguments made by knowledgeable resource economists have explained the historical pattern, such as the 1997 article by Adelman and Lynch. The petroleum resource base is huge, at least ten times what is described by peak oil advocates, and price spikes reflect temporary supply disruptions or the removal of some of the ‘cheap’ resource from the accessible portion of supply by resource nationalism. Peak oil advocates were following the long-standing neo-Malthusian practice of interpreting short-term problems as permanent and insoluble, just as was done in the 1970s. (continued on page 3)

<

Tellingly, those believing in peak oil often displayed a certainty that was totally unwarranted, given the complexity of the issue. The 1998 Scientific American article stated bluntly, “Predicting when oil production will stop rising is relatively straightforward once one has a good estimate of how much oil there is left to produce.â€Â (They predicted the peak within ten years; that was 20 years ago.)

Ken Deffeyes went further, actually predicting a peak in global oil production on Thanksgiving Day, 2005.   The incredible precision of such a prediction did not seem to him to be unlikely. Other comments:

Greenpeace official Rex Weyler made the confident statement, “Oil company cheerleaders proclaiming huge supplies of oil are dead wrong. Peak oil is as real as rain, and it is here now. Not 2050. Not 2020. Now.â€Â (That was in 2012)

“I wasn’t going to post on this since I have blogged endlessly on the painfully obvious reality that we are at or near the peak (see “Peak Oil? Bring it on!“).â€Â  Joe Romm 2009

“But others held it up as convincing proof of the notion that the world’s oil production would soon reach a pinnacle, never to be exceeded.†  The Economist in 2008, discussing the Simmons book Twilight in the Desert.

“This is not a controversial statement. It is just a question of when.†  Jeremy Leggett in 2006

And those who disagreed were treated with derision.

“In a world where fact-checked information were valued over mere argumentation, where intelligent inquiry and dialogue were preferred to invective-laden diatribes and declarations of fact-free faith, the voices of Lynch, Yergin and Learsy would never be heard, let alone paid large sums of money for “proprietary†information about their foolish dreams.â€Â  Chris Nelder 2009

<

“At a 2005 conference on oil in Italy, I listened to the former US Secretary of Energy, James Schlesinger, liken denial about peak oil—in the face of all the emerging evidence—to Pompei’s citizens ignoring the rumblings below Vesuvius.â€Â Leggett in Half Gone p. 277 Others have compared those who didn’t agree with peak oil arguments to Neville Chamberlain at Munich, ignoring looming disaster.

“They are cornucopians who cannot fathom the possibility of limits to growth.† Kurt Cobb 2005

Not surprisingly, few of those who were so certain about peak oil have admitted to being wrong, or simply commented, as Joe Romm did, “The idea of peak oil supply — the notion that our reach (demand) for oil would exceed our grasp (global supply) — is dead.â€

Richard Heinberg, a one man apocalyptic industrial complex, falls back on the idea that peak oil occurred in 2005—peak conventional oil.   Thus, the peak oil theor(ies) were not disproven, but the event delayed, primarily because fiscal policies led to a flood of capital into, for example, U.S. shale production, but, he says, “Like all debt bubbles, the fracking bubble is going to burst at some point. No one knows whether that will happen later this year, next year, or five years from now. But burst it will.†Apparently, he thinks the 2008 oil price surge was not a bubble, but shale oil production is.

Many others have simply ceased to discuss the subject. Theoildrum.com has closed down, the Association for the Study of Peak Oil no longer holds conventions (or does very much at all), and one reporter found it hard to locate most of the original theorists or get them to respond.  Some sites, like peakoil.net, are now more focused on environmental questions, although theoilage.org is still active.

The question of why remains paramount. As Financial Times’ Ed Crooks correctly noted, “It’s worth noting, incidentally, that although the Peak Oil supply pessimists may have been fundamentally wrong, they were more useful for predicting the market of 1999-2013 than many people who were fundamentally right.â€

So, whereas the Ptolemaic model of the solar system outperformed the initial Copernican model, that was not evidence of its scientific validity. As I noted many times, there’s a big difference between being smart and lucky. If you predict a stock market crash for your entire career, you will occasionally be right, but that doesn’t mean you understand the market. In a 2001 Oil & Gas Journal article, entitled “A New Era of Oil Price Volatility†I described market factors that I expected would make prices more volatile and higher. How much higher? Well, $26 as the new mean. (Embarrassed cough)

So, the peak oil theorists got lucky in that the industry experienced a large number of supply disruptions that raised prices, which seemed to confirm their arguments—just as the Iranian Oil Crisis of 1979 incorrectly convinced many that ever-higher crude prices were unavoidable and resource optimists naive. But by understanding that supply disruptions in Iraq, Libya, Venezuela and so on were responsible for higher prices, it is possible to recognize that political trends in oil exporting countries will determine prices, not resource scarcity. Recognizing the former means coping with cyclical prices, believing in the latter means getting blindsided by every major price decline.

Now, with production problems in Libya and Venezuela (and maybe Iran) pushing prices towards $80 a barrel, the industry is warning against irrational exuberance and urging capital discipline—just like it did in the early 2000s, only to give into the siren call of high prices. Let’s hope the next price crash doesn’t bring similar pain.

Check out our other current stories, we dare you….