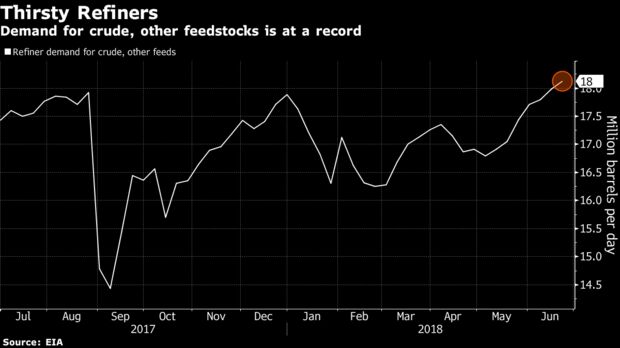

U.S. refiners have returned from maintenance with a vengeance, processing more than 18 million barrels a day of crude and other oils for the first time in the week ended June 22. What does that mean for the markets?

Gasoline stockpiles have increased 2.9 percent in June, the biggest gain for the month since 2009. There’s enough supply to cover 25.4 days of demand, almost a full day above the five-year average.

Shrinking Margins

The record runs are squeezing the once-mighty profit margins for refiners. The Nymex gasoline crack spread, a rough measure for how much refiners make from producing the motor fuel, sank more than 30 percent in June, the biggest drop for the month in a decade, helped by a tightening WTI-Brent spread.

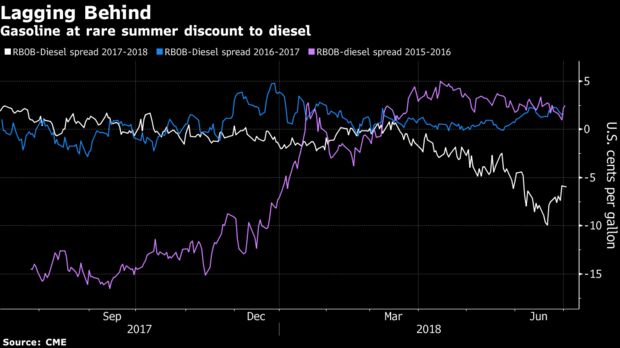

Out of Tune

With gasoline the weakest relative to diesel seasonally in five years, refiners are pushing out motor fuel into a swamped market. Typically, production maxes out in the summer to meet driving demand, and refiners are “tuned†to produce more of the motor fuel. A glut of gasoline will weigh on margins, given it’s almost twice the yield of distillate.

“These prices that we are seeing at the pump are going to dissuade growth on the consumer side. On the diesel side, prices are still a little lower than they had been–there was still some room to run,†said Ashley Petersen, lead oil analyst at Stratas Advisors in New York. “It’s a little easier for shipping companies to distribute those costs than it is for John Smith who is paying $3.50 at the pump to distribute that in his monthly budget.â€

Refining, Exports

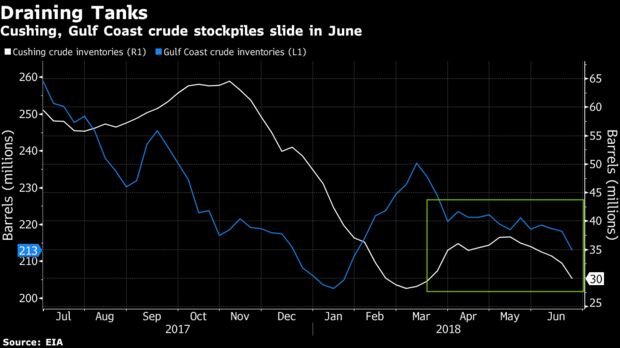

The refining bonanza typically leads to declines in U.S. crude stockpiles as refiners increase demand for oil to process. Crude inventories are sliding, after lagging previous years’ declines for the beginning of peak driving season.

Record crude production from the Permian Basin can’t keep up with all-time high demand from refiners and exporters. Stockpiles posted the biggest June drop on a percentage basis since 2009, tumbling across the Midwest and Gulf Coast.

Pump Prices

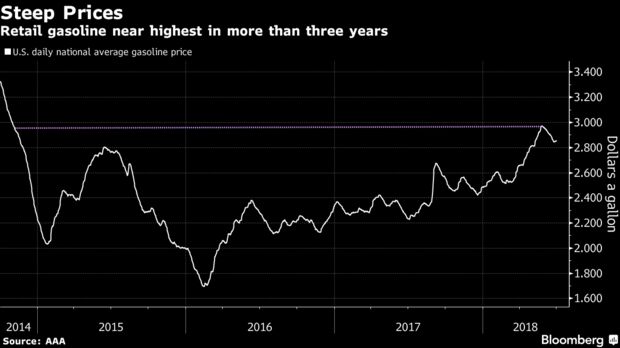

On a four-week average basis, gasoline implied demand is the lowest seasonally since 2015, and falling at a time when it normally increases. The latest monthly data show April demand was down 0.7 percent from a year earlier, according to the Energy Information Administration.

“Now that demand is starting to evaporate as a function of the price being too high, people are going to say ‘I’m not driving to Maine this summer. I am going to drive to the Jersey Shore for my five-day vacation instead,’†said Bob Yawger, director of futures at Mizuho Securities USA Inc. in New York. As a result, you’ll “have all this gasoline laying around.â€

Some of the apparent demand weakness could be due to exports of the fuel, which have run well above historical levels this spring. Higher pump prices may also put a damper on demand. Retail gasoline flirted with $3 a gallon before falling back, and is still about 60 cents a gallon more expensive than a year ago.

It’s typical to see demand increase around the U.S. Independence Day holiday and into the rest of the summer, according to Nick Holmes, an analyst at Tortoise in Leawood, Kansas, which manages $16 billion in energy-related assets. “The next 45 days will be important†in terms of evaluating the demand trend for the remainder of the year, he said.

Check out our other current stories, we dare you…