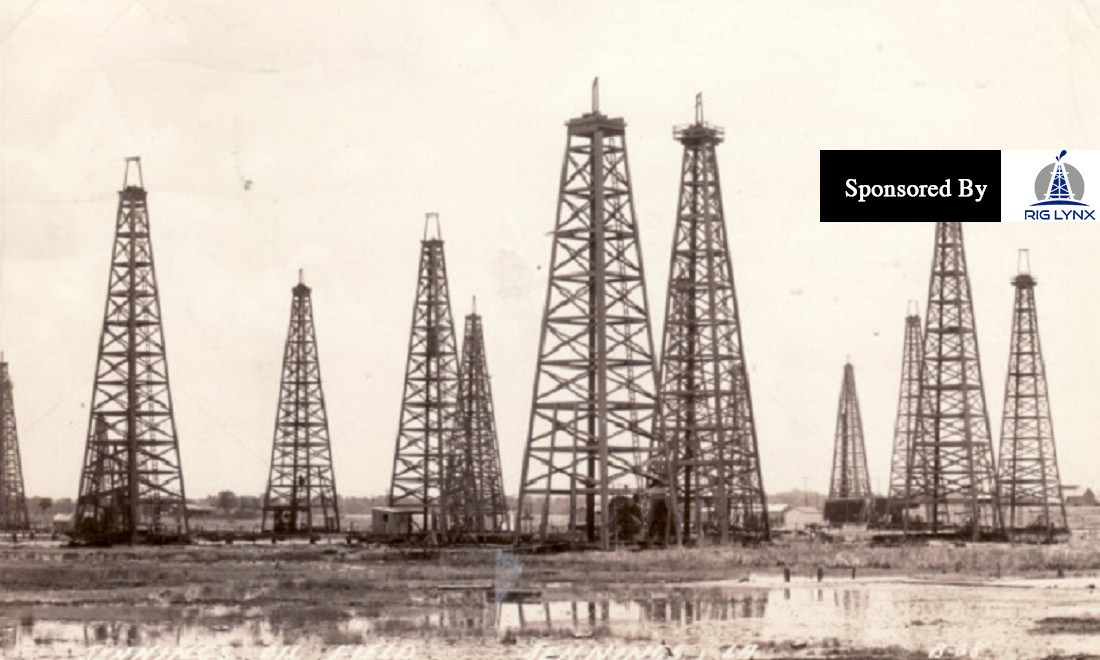

The first Louisiana oil well discovered the giant Jennings oilfield in 1901 and launched the Pelican State’s petroleum industry. Almost a quarter million wells would be drilled by 2014.

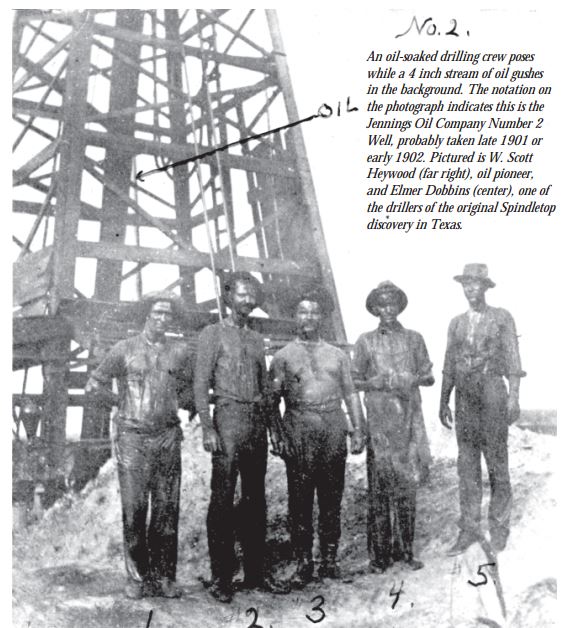

Nine months after the 1901 headline-making oil discovery at Spindletop, Texas, oil erupted 90 miles to the east. W. Scott Heywood – already successful wildcatter at Spindletop – drilled a well that revealed the Jennings oilfield. His September 21 Louisiana gusher initially produced 7,000-barrels of oil a day.

Mrs. Scott Heywood, “the widow of Louisiana’s oil discoverer, the late W. Scott Heywood,†unveiled an historical marker on September 23, 1951, as part of the Louisiana Golden Oil Jubilee. Times Picayune (New Orleans) image courtesy Calcasieu Parish Public Library.

Louisiana’s first commercial oil well came in on the Jules Clements farm about seven miles northeast of Jennings. Local investors earlier had formed the Jennings Oil Company and hired Scott, who recognized that natural gas seeps found nearby were nearly identical to the conditions observed at Spindletop.

Scott would insist on drilling deeper than many investors thought wise.

“At the age 29, W. Scott Haywood was already a seasoned, experienced and successful explorer,†notes the Louisiana Geological Survey (LGS). “He had gone to Alaska in 1897 during the great Yukon gold rush, sinking a shaft and mining a profitable gold deposit.â€

Haywood as one of the first to reach Spindletop following news of the “Lucas Gusher of January 10, 1901.

Haywood, who also had drilled several successful oil wells in California, convinced the reluctant Clements to allow drilling in the farmer’s rice field. The Clements farm was at the small, unincorporated community of Evangeline in Acadia Parish, northeast of Jennings.

The Jennings Oil Company No. 1 well, which discovered the first commercial oilfield in Louisiana on September 21, 1901. Photo courtesy Louisiana Geological Survey.

However, after drilling to 1,000 feet without finding oil or natural gas, the Jennings Oil Company’s investors wanted to abandon the first attempt.

“After all, 1,000 feet had been deep enough to discover the tremendous oil gushers at Spindletop field,†explains Scott Smiley of the LGS. “Instead of drilling two wells to a depth of 1,000 feet each, Heywood persuaded the investors to change the contract to accept a single well drilled to a depth of 1,500 feet.â€

More drilling pipe was brought in and the well deepened.

Heywood finally found oil at 1,700 feet – after some discouraged investors had sold their stock when drilling reached 1,000 feet. By 1,500 feet, stock in the Jennings Oil Company even sold for as little as 25 cents per share. Patient investors were rewarded with the gusher of 7,000 barrels of oil per day.

W. Scott Heywood

According to the Jennings Daily News, “The well flowed sand and oil for seven hours and covered Clement’s rice field with a lake of oil and sand, ruining several acres of rice.â€

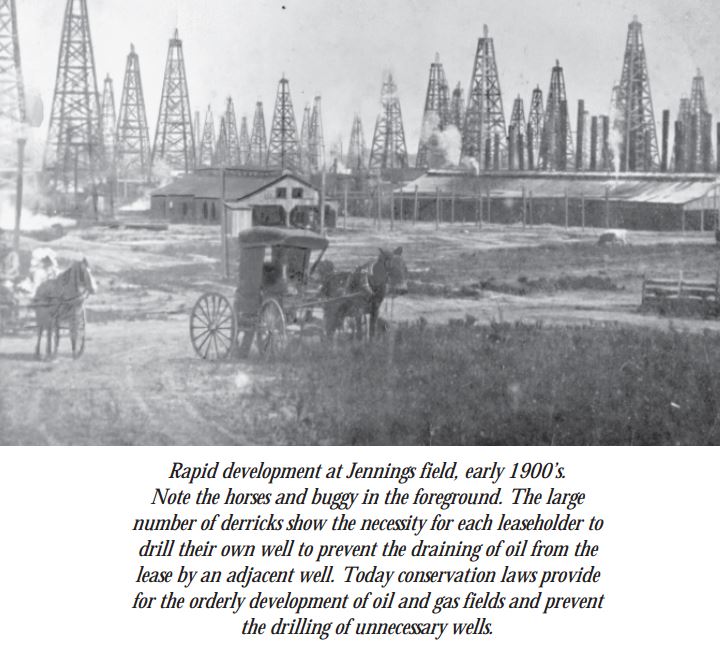

Although the Jules Clements No. 1 well is on only a 1/32 of an acre lease, it marked the state’s first oil production and launched the Louisiana petroleum industry. It opened the prolific Jennings field, which Heywood developed by securing leases and building pipelines and storage tanks.

The Jennings oilfield reached its peak production of more than nine million barrels in 1906. Meanwhile, an October 1905 discovery in northern Louisiana further expanded the state’s young petroleum industry. Visit the Louisiana Oil City Museum.

Haywood returned to Alaska in 1908 on a big-game hunting trip. He retraced much of his travels to the Klondike gold fields, notes Smiley.

“After a brief retirement in California, he returned to Jennings and drilled several wells at Jennings and elsewhere in Louisiana,†Smiley reports, adding the he also found success at the Borger and Panhandle oilfields in Texas.

“Heywood returned to Jennings in 1927 and assisted Gov. Huey P. Long in passing legislation to provide schoolbooks for children,†concludes the LGS geologist in Jennings Field – The Birthplace of Louisiana’s Oil Industry, September 2001.

Photo courtesy Louisiana Geological Survey.

Photo courtesy Louisiana Geological Survey.

Â

Presently

Petroleum

Louisiana’s offshore petroleum industry experienced a serious setback in 2005 when Hurricanes Katrina and Rita damaged offshore platforms and curbed production and refining for several months. In 2008, hurricanes again caused damage and forced refining and production platform shutdowns. In April 2010, 40 miles off the Louisiana coast, an explosion and fire sank the Deepwater Horizon drilling platform, killing 11 workers and resulting in the largest crude oil spill in U.S. history. In less than three months, an estimated 4.9 million barrels of crude oil were released into the Gulf of Mexico. The spill resulted in two temporary moratoria on new deepwater drilling in the Gulf. New safety rules were created for offshore drilling, and new requirements for oil spill response and containment were adopted. The federal agencies that oversee offshore drilling were also restructured.

Louisiana is among the top three states receiving foreign crude oil imports. Crude oil is shipped into several ports, including the Louisiana Offshore Oil Port (LOOP). The LOOP, which began receiving foreign crude oil in 1981, is the nation’s first and only deep-water oil port. It provides offloading for some of the largest tankers in the world and can receive between one and two million barrels per day. It is the single largest point of entry for waterborne crude oil shipped to the United States. The LOOP’s onshore facilities include the Clovelly Dome Storage Terminal, where nearly 60 million barrels of crude oil can be stored in underground salt caverns. Above-ground storage is being expanded to hold more than 10 million barrels. Through a network of crude oil pipelines, the LOOP is connected to more than half of the refining capacity in the United States. With U.S. oil production increasing, the Clovelly Dome storage facilities are used for domestic as well as imported crude oil. The LOOP is adding loading capability for U.S. crude oil exports.

Louisiana is home to two of the four storage sites that make up the U.S. Strategic Petroleum Reserve, which is capable of holding an emergency stockpile of 727 million barrels of oil. At the two Louisiana sites-Bayou Choctaw and West Hackberry-crude oil is stored in 28 underground salt caverns with a storage capacity of almost 300 million barrels.

Louisiana’s 18 oil refineries account for nearly one-fifth of the nation’s refining capacity and are capable of processing more than 3.3 million barrels of crude oil per day. Many of the state’s refineries are sophisticated facilities that use refining processes beyond simple distillation to yield a larger quantity of lighter, higher-value products such as motor gasoline. Louisiana refineries can process a wide variety of crude oil types from around the world.

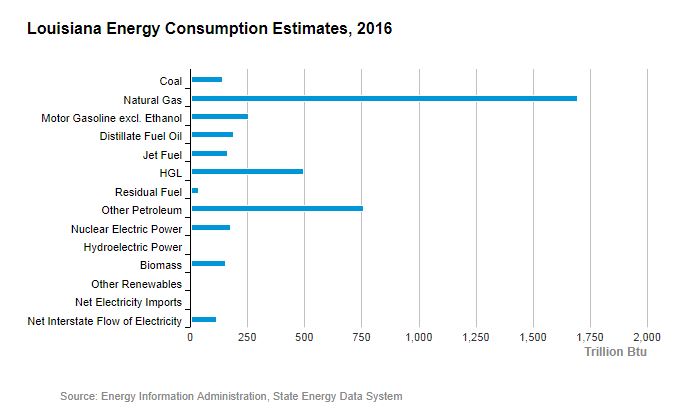

Most of Louisiana’s refined petroleum products are sent out of state. The 3,100-mile Plantation Pipeline Network, one of the nation’s largest refined petroleum product pipelines, runs from near Baton Rouge, Louisiana, through several southern states and ends in the suburbs of Washington, DC, supplying much of the South with motor gasoline, jet fuel, diesel, and biodiesel. Several other major product pipeline systems also pass through the state. Refineries also supply Louisiana’s industrial sector, particularly the petrochemical industry. Louisiana has one of the largest concentrations of petrochemical manufacturing facilities in the United States. Consequently, Louisiana’s total consumption and per capita consumption of petroleum are both among the highest in the nation.

Natural gas

Louisiana is one of the top five natural gas-producing states in the country. The state accounts for about 6% of U.S. marketed gas production, and holds about 5% of the nation’s proved dry natural gas reserves. Among its many productive areas is the Haynesville Shale, which is one of seven key U.S. natural gas-producing regions. Recent increases in drilling activity and well production rates have raised natural gas production in the Haynesville region to its highest level since 2013. Louisiana is also a top natural gas-consuming state. About 90% of its gas production is consumed in the state, most of it by the industrial sector.

Louisiana delivers the remaining 10% of its natural gas production to other states via a vast network of interstate pipelines. About 60% of the natural gas entering Louisiana comes from Texas. Most of the rest comes onshore from the federal areas in the Gulf of Mexico leased to energy companies. Louisiana plays an essential role in the movement of natural gas from the U.S. Gulf Coast region to markets throughout the country. The state has the most active natural gas market center in North America-the Henry Hub in Erath, Louisiana-where nine interstate and four intrastate pipelines interconnect to provide natural gas to major markets throughout the country. The Henry Hub is the benchmark price location for natural gas physical and futures trading on the New York Mercantile Exchange.

Nineteen natural gas storage facilities are located in salt caverns and depleted fields in Louisiana, providing about 8% of U.S. total storage capacity. Those facilities allow Louisiana to store natural gas when national demand is low and to quickly ramp up delivery when markets across the country require larger volumes. Historically, natural gas demand is highest in the winter, when it is needed for home heating. With the growing use of natural gas for U.S. electricity generation, Louisiana now withdraws natural gas from storage during the summer months as well, when electricity demand rises for air conditioning.

In February 2016, the Sabine Pass liquefaction plant and tanker terminal opened, giving Louisiana the first large-scale liquefied natural gas (LNG) export terminal in the Lower 48 states. When fully operational, the terminal will be to process 3.5 billion cubic feet of gas per day. Sabine Pass, like Louisiana’s two other LNG terminals, was originally designed for imports. All three terminals are in the process of adding capability to export LNG. The world’s first deepwater LNG import facility, the Gulf Gateway Energy Bridge Deepwater Port, was located 116 miles off the Louisiana coast in federal waters. Commissioned in March 2005, this facility delivered natural gas to the Gulf Coast region through two offshore pipeline systems until Hurricane Ike damaged both pipelines in September 2008. The port was decommissioned in 2012.

Industrial processes use two-thirds of the natural gas consumed in Louisiana. Electricity generation consumes another one-fifth. More than one-third of Louisiana households rely on natural gas for home heating, but the volume consumed is small because of the state’s mild winters. In most years, residential natural gas use is less than the amount used statewide by pipelines to maintain pressure. Louisiana’s pipeline use of natural gas is among the top three of any state in the nation.

For more of America’s oil and gas history, visit AOGHS

Original Articles Here

Check out our other current stories, we dare you…