Been tons of chatter over the last few weeks about DUC(S) so lets have a quick rundown on what they are.

A DUC is by definition: a well that has been drilled and has not yet been completed.

As you can imagine that there are many organizations and smart people out there trying to see how these “DUC(S)†play into production estimates further into the future, more importantly what it will mean for overall supply and demand.

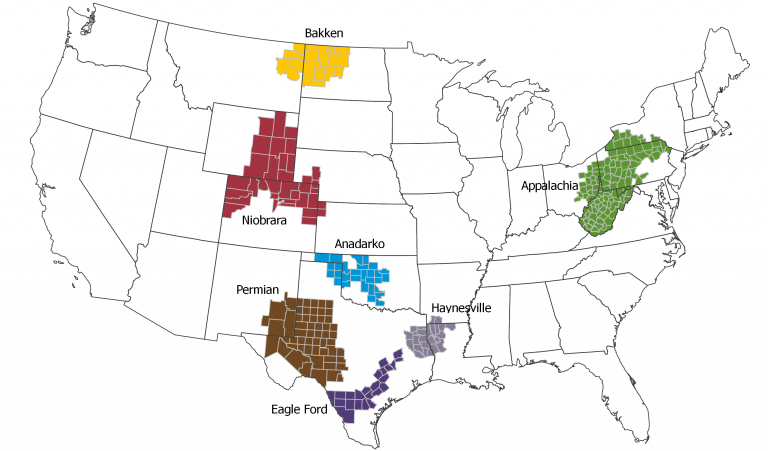

The latest report from the EIA shows the following by region:

| Drilled but uncompleted wells (DUC)Â wells | |||

|---|---|---|---|

| Region | November 2018 | December 2018 | change |

| Anadarko | 1,070 | 1,077 | 7 |

| Appalachia | 556 | 529 | (27) |

| Bakken | 742 | 731 | (11) |

| Eagle Ford | 1,520 | 1,561 | 41 |

| Haynesville | 187 | 193 | 6 |

| Niobrara | 458 | 455 | (3) |

| Permian | 3,843 | 4,048 | 205 |

| Total | 8,376 | 8,594 | 218 |

If you look to the right hand side of EIA’s report you will see the DUC data in excel format, it has all the previous years, so for us it looks like there has been a substantial carry over of over 4k DUC(S) since Dec 2013, assuming that was the starting of the tracking period for this particular item with EIA.

Overall it is showing a current total of 8,594 of these wells, how many of these wells do you think have the potential to come online? If you break down the future capex requirements, which we will not do in this post, and begin to place them around different basins by ownership, you can see in the short term what will come online but long term, who knows what kind of effect this will have.

Needless to say, upstream nor downstream are ready for a significant amount of these wells to come online at one time, thats for sure.

Photo: Public Domain

If you like what we do then let us know by becoming a patron through Patreon, for as little or much as you would like! Hit the button below!

Check out our other current stories!