Over 94 percent of public land offered during the Wyoming Bureau of Land Management’s quarterly oil and gas sale received bids, further expanding the reach of energy development. The sale brought in $22 million, with about half the earnings going to the state.

Second quarter earnings came in far below the $100 million collected in March — a month with two separate oil and gas lease sales. The bureau rescheduled last year’s final quarterly sale to Feb. 25 to March 1 due to concern over the potential disruption of a mule deer migration corridor on nominated parcels of land.

Despite fewer acres offered and less revenue garnered during the second quarter’s auction, the practice of leasing public land to energy developers showed few signs of slowing down.

Wyoming’s $22 million quarterly sale was a “bright spot†nationally, according to Pete Obermueller, president of the Petroleum Association of Wyoming. “I hope it’s a trend, because there’s no debate that oil and gas are the economic drivers for the state.â€

Last year, oil and gas lease sales generated $117 million.Â

In addition to economic benefits of each sale, several parcels auctioned this month fell in some of the state’s most economically depressed counties, such as Goshen. The potential development could be a positive for these communities, Obermueller said.Â

For the two-day auction held Tuesday and Wednesday, the bureau listed 205,000 acres of industry-nominated land in all corners of Wyoming. Second quarter sales averaged 1,282 acres, with the most acres available for leasing in Sweetwater County.

Tensions between oil and gas operators, government agencies and conservationists continue, especially given the uptick in land available for leasing in the state’s Golden Triangle.

Environmental groups have been regular opponents of the auctioning of public land to oil and gas industries, citing the harm energy development could wreck on vulnerable sage grouse and mule deer populations, along with the consequences of rising carbon gas emissions.

This quarter was no exception. Two formal protests were submitted by environmental groups during the comment period, including from the Sierra Club.

“This quarter of leasing builds on what has been an unprecedented level of leasing over the last two or more years,†said Connie Wilbert, director of Sierra Club Wyoming Chapter. “We are deeply concerned about the cumulative impact all of these sales will have on the environment.â€

The bureau sought recommendations from the Wyoming Game and Fish Department to consider potential environmental impacts of oil and gas construction. A day before the sale began, the bureau dismissed the two protests. In an effort to roll out the Trump administration’s energy policy, oil and gas leasing practices underwent changes — the agency moved sales online and shortened public input time.Â

This quarter, the agency set aside five parcels of land that would intersect with migration corridors, according to Courtney Whitman, a representative for the bureau.

But a recent study by the Center for American Progress found 20 percent of Wyoming leased land in 2017 and 2018 overlapped with protected areas.

“If our mule deer populations and the greater sage grouse habitats are in trouble, then our way of life in Wyoming is in trouble,†said Dustin Bleizeffer, communications director of the Wyoming Outdoor Council. “The good news is that we can have energy development in Wyoming without sacrificing our wildlife and there are safeguards that we can put in place.â€

But to Obermueller of the Petroleum Association, oil and gas can take steps to mitigate harm while still operating.

“We are 100 percent on board to make sure that legitimate migration corridors are made viable,†he said. “When we can identify a migration corridor, oil and gas can fit within that context.â€

About half of the revenue accumulated from quarterly oil and gas lease sales goes toward the state’s budget, a welcomed stream of funds given the uncertain future of the state’s coal industry.

Oil and gas revenue may be a boon for the state’s budget, but Gov. Mark Gordon has announced plans to advance new economic initiatives in an effort to wean the state from its dependency on energy revenue.

There is “no substitute†for oil and gas revenue, Obermueller said. “All this talk about diversifying our economy, I have no trouble supporting that,†he said. “But in the interim, this is what Wyoming needs.â€

The bureau announced it will offer another 322,000 acres during September’s lease sale.

Source: Casper Star Tribune

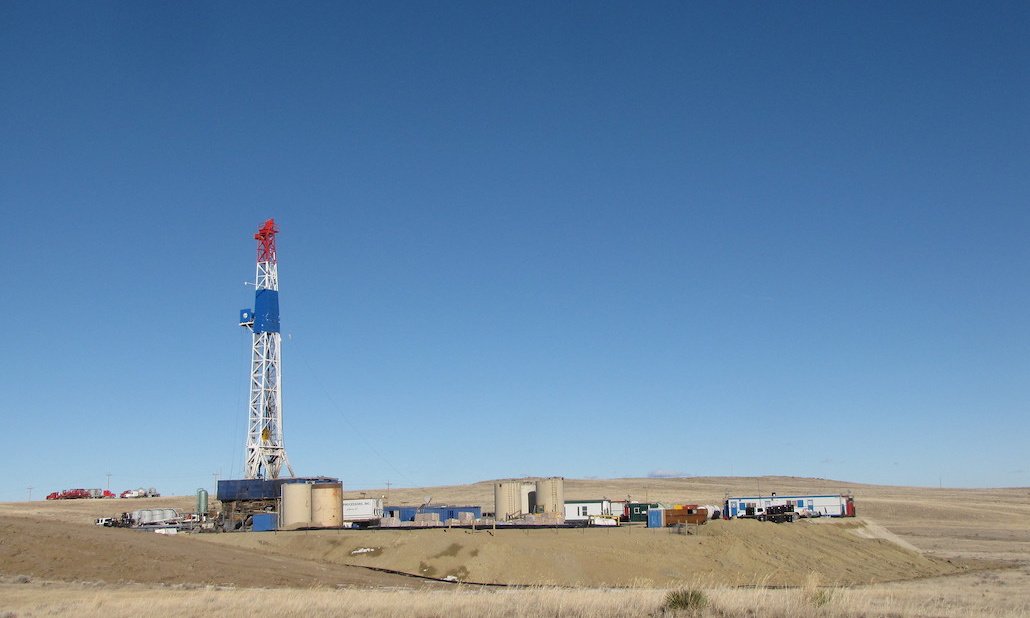

Photo used under CC 2.0 Author: Bureau of Land Management

Check out our other current stories!

- Two killed on Shell’s Auger TLP

- Popular News – Top 5 from this past week!

- “We foresee demand of 172 units by 2021†says Rystad on floater activity

Rig Lynx was launched December 2017, our oil and gas news was viewed over 373,000 times in 2018 and our social networking application generated over 268,000 clicks in 2018. Our current foothold has rivaled the largest in the industry and we are just getting started.